Getting your first credit card can be difficult and stressful. There’s a lot to look for and think about. Should you get a card from your bank, a department store, or one that you saw someone recommend online?

Getting your first credit card can be difficult and stressful. There’s a lot to look for and think about. Should you get a card from your bank, a department store, or one that you saw someone recommend online?

There are a lot of questions to ask, but luckily once you learn the few things you need to know, it’s really not too complicated.

I’m going to show you exactly what you need to look for when getting your first credit card.

The Must Haves for Your First Credit Card

Regardless of what you spend the most money on or how good your credit score is, there are a few things that you should make sure your first card has. Then after you’ve built your credit score, if you want to look around and get a second card for better cash back or points based on what you buy a lot of, that’s great.

But for your first one you need to get a card that has these three things:

- No Annual Fee

- Free Credit Score

- Good Customer Service

Your first card should have no annual fee. This is because you want to get a card that you can keep forever and never have to get rid of. Sometimes it makes sense to get a card with an annual fee (if your cash back offsets the fee), but one day you might want to cancel the card because your spending habits have changed. This is why you should go with a no-fee card for your first one.

The second thing is making sure it provides a free credit score. There are many cards that provide you with free credit scores every single month, so you would be stupid not to take advantage of this. Remember, the purpose of your first credit card is to primarily help you build credit. So don’t get caught up in other fancy benefits, points, and cash back. Just focus on finding a good solid starter card.

Nerdwallet has a great article that lists the different credit cards that offer free monthly credit scores, check it out here.

Excellent customer service should be your other main concern for your first credit card. Hopefully, you will have this card for a long time. So be sure and read reviews about the card before you apply and look for good reviews that specifically talk about high-quality customer service.

Get a Mainstream Card – Not a Bank or Store Card

Most of the time, cards tied to your local bank don’t have as good of benefits as more mainstream cards like Discover, Chase, American Express, Citi, or Barclay. They typically are a bare bones credit card. So if you’re going to get one, you may as well get a card with some good benefits like excellent rewards programs and free credit scores.

For the same reason, you probably shouldn’t get a store card for your first credit card. Sure, store specific cards like Belk or Banna Republic might have excellent rewards and store specific discounts. But hopefully, the majority of your spending won’t be in there. It’s also very rare for these store specific cards to provide you with a free credit score.

For your first credit card, you want to get something that will give you good perks on the majority of your purchases. Like a card good for gas and groceries, or one for online shopping. Don’t waste your time with the store branded cards just yet.

Figure Out What Type of Credit Card You Will Qualify For

Depending on your situation, you may not be able to get certain cards at first. I recommend opening a free account on Credit Sesame that will tell you what your credit score is. This will give you a good idea of where to start.

Let’s look at 3 different situations you might be in for your first card:

No credit history and no job. You have no credit score at all and don’t have a job that makes a reasonable amount of money. Typically this would be for college students who aren’t working very much if any at all. They haven’t started paying on their student loans yet and don’t have any other debt.

If this is you, you will probably need to start with getting a secured credit card. This just means that you don’t have any credit history and will need a super basic starter card. Secured credit cards have you put a cash deposit down of like $500 that is only taken if you don’t pay your credit card. After a few months, you will have enough credit score to cancel that card, get your deposit back, and get your first real credit card.

Limited credit history, student, part time job. This would be for a college student who is working part-time and is able to show some income. It might not be considered a full-time income or salary, but it is substantial enough to cover a small credit card payment of $500 – $1,000.

If this is you, there are some great options out there for student cards like the Discover it student and the Citi Thank You Preferred for College Students.

Limited credit history and working full time. You’re out of college or never went to college and have a full-time or part-time job that brings you income. Maybe you just never got a credit card before because you didn’t want one, didn’t understand them, or didn’t need one.

For whatever reason, now you would like one. Although you don’t have any credit history, depending on your income you will still be able to qualify for normal cards like the Chase Slate and the Discover it.

Don’t Worry About the Interest Rate

If you’re using credit cards like you should be, you won’t be carrying a balance on this card ever. You will be paying it in full each and every month while never spending more than you can afford. If you don’t have the money in your checking account, don’t buy stuff. Period.

As long as you’re doing that, you don’t need to worry about what the interest rate is because you’ll never pay it.

Consider What You Purchase The Most Of

Although it may be difficult to qualify for a good rewards card for your first one, it’s still worth looking at.

Ask yourself what you spend the most money on. Is it things like gas and groceries? Maybe you like to travel a lot? Or maybe you do a lot of shopping at online stores like Amazon?

There are all kinds of credit cards out there, just google “credit cards good for _____________” <– insert your spending category there.

Just remember that for your first card, focus on no annual fee, free credit score, and good customer service.

You can worry about getting an excellent rewards card later.

Apply for the Credit Card

Once you’ve decided on a card it’s time to apply. Surprisingly, the application process for cards today is very easy. You can apply, be approved, and finish the whole process in less than 20 minutes.

All you need is your personal information like name, birthday, social security number, and income. You can fill out the online application and call a customer service rep if you really need to.

Sometimes if you have no credit history you may have to get on the phone and talk to a representative who will ask you some questions about your income. But overall, it’s a pretty painless process.

Read the Main Points of the Terms and Conditions

Once you are approved, you’ll want to download the terms and conditions. I know they’re incredibly long, but you don’t have to read the whole thing.

There are a few key points though that you will want to take note of. At the very least read far enough to understand the specific terms related to these points:

- Annual percentage rate for purchases

- Closing date for billing cycle

- Due date for bill payment

- Penalties for late or missed payment

- Annual fee

- Cash advance fee

- Special terms or bonuses for account opening

- Special terms for cash back or rewards

If you need more information about these points, I’ve gone into great detail about understanding them in an article called Everything You Need to Know About Credit Cards.

Activate the Credit Card and Sign Up for Auto-Pay

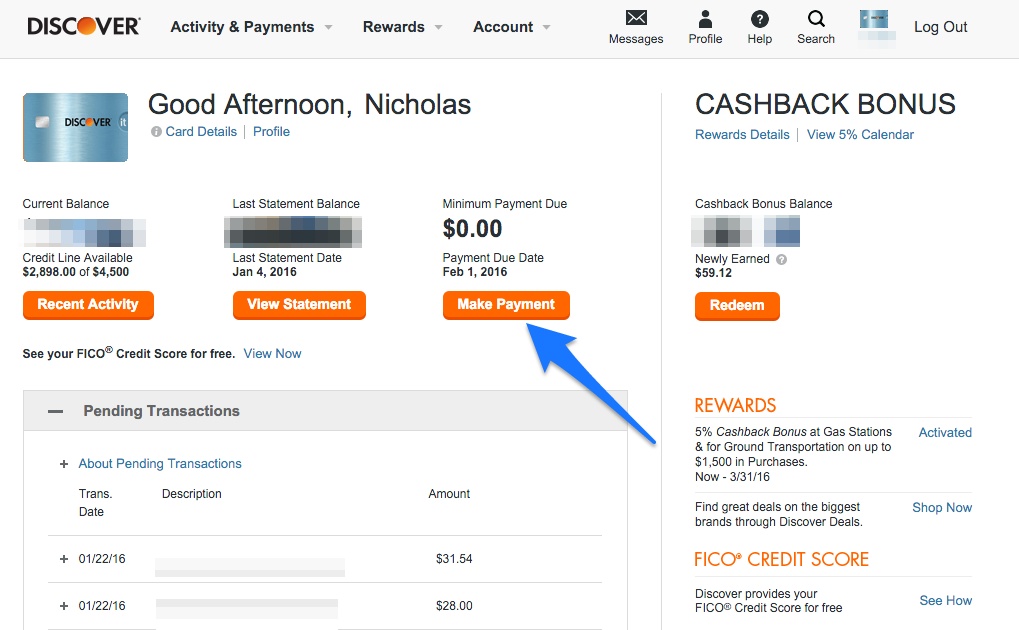

The last step is to activate the card when it comes in the mail and set up your online account. You will need to create a specific username and password for that credit card website and then link your bank account to the credit card.

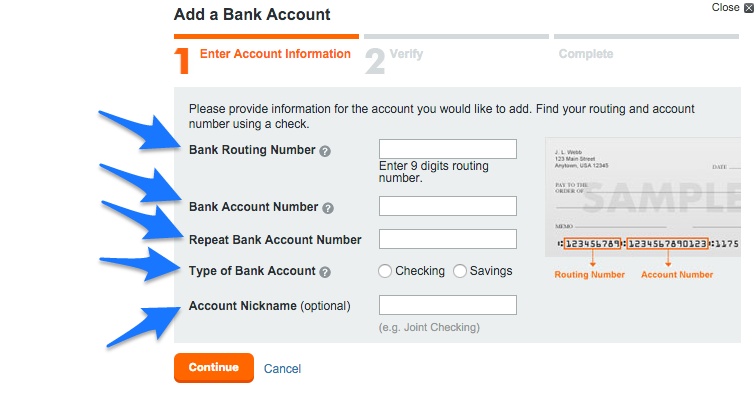

Here’s an example of what it looks like to link a Bank Account using Discover:

Log in and go to the main page, then click on make a payment.

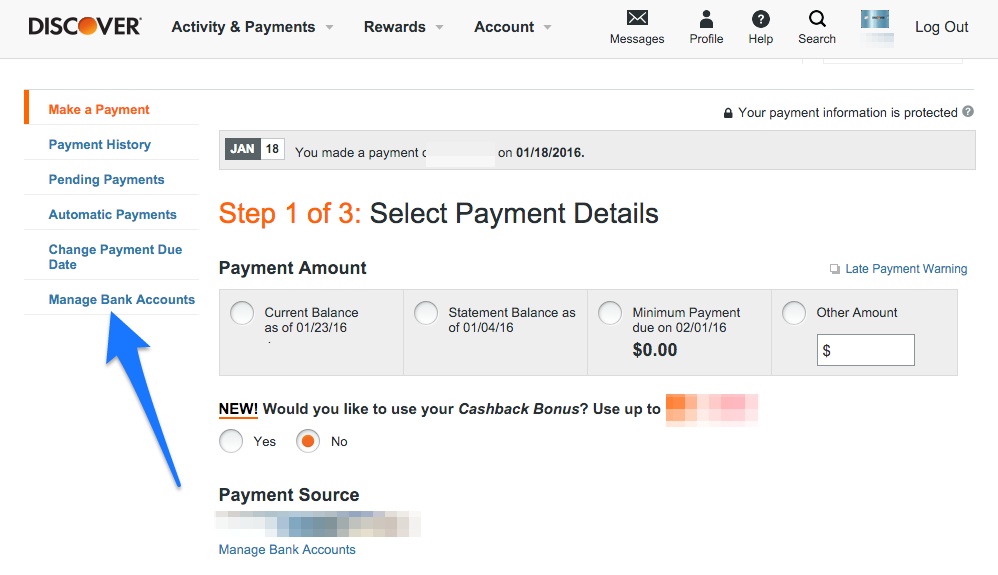

Choose manage bank accounts.

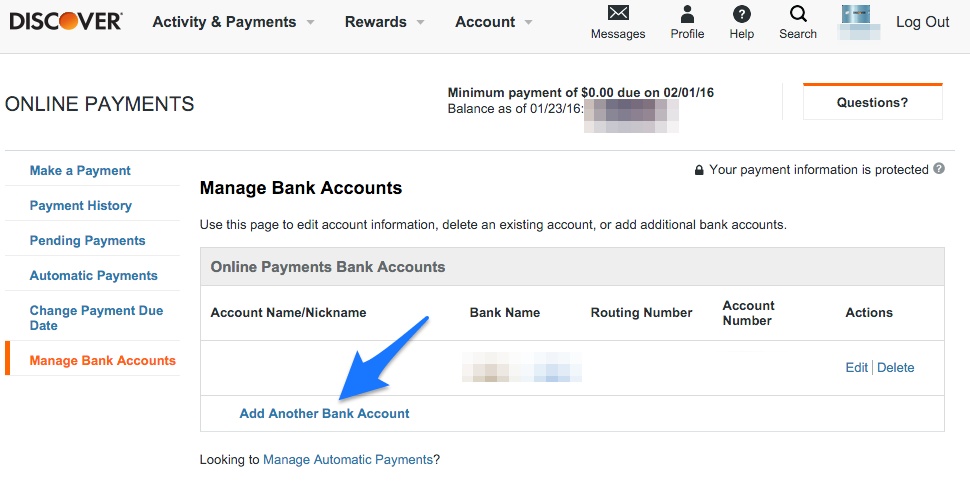

Click add another bank account.

Fill in the bank information which you can get from your bank or your checkbook.

Then just click continue and you’re good to go.

Once you’ve done that, you will want to set up auto pay with your bank. Be sure to set the credit card to pay in full every single month on a certain day. By doing this, you will never miss a payment and you’ll never pay any interest.

Just always make sure that you never purchase anything you don’t already have the money for.

Hopefully, this helped you understand what you need for your first credit card. Let me know in the comments below what credit card you think is best and why!

This is super helpful, but I have a fourth situation. What about medical/graduate students who are receiving a yearly stipend but not a technical salary? Can that be listed as salary? Should one talk to a representative and explain?

Thanks!

Thanks Hendrik for reading. To answer your question:

Keep in mind that credit card companies don’t care if it’s “salary” or freelance income or payment for research etc… All they care about is that you have some income that could reasonably cover the amount you charge. They just want to make sure they get paid. So yes, if you are receiving a stipend that comes to you in the form of income to your personal bank account I would include that as earned income when I filled out the credit card application. That’s different from say scholarship money that gets directly applied to tuition.

In general, if it’s income that you have access to, you’re good. I would still probably apply for a student credit card like the discover student or the capital one student unless you have a spouse who you’re applying with. The main difference is that you will just start out with a low credit limit of between $250 – $2,000 because the credit card company knows you don’t have a lot of income and probably do have high expenses like tuition, books, room and board etc…

If you’re still curious or want more in depth answers I would contact customer service at the company you’re wanting to apply to. Or just go to their website and see if there is a live chat option. This is more and more common today and I use this feature all the time to ask questions before I apply for cards or bank accounts.

Hope this helps!

This is kinda specific, I was looking at the discover it card for students for my first card. There were two different card the Chrome or the cash back card. Is the only different the % back categories? Or is there more that I was not seeing. I ask because I have an hour commute to work so I did the math I believe the 2% for the chrome card will be better than the 5% for a quarter (I did include other estimated expenses for the other 5% quarters). Thanks, Austin

Hey Austin, this is so awesome to hear that you ran the math to see what made the most sense. I agree that with the commute and what typical students spend in the other categories, my gut says the 2% card may make more sense for you.

As for your question, no, they should be identical in everything else. No annual fee, good grades bonus, free FICO score etc… They also both have the double your cashback match after the first 12 months. So that’s great too!

The only difference that you should factor into your calculations is that they have different caps on rewards spending limits.

The Chrome card lets you earn 2% up to $1,000 in spending per quarter on gas and restaurants. So if hit that limit, you’ll make $20. So it’s not like you’ll make a killing. However, the 5% calendar is up to $1,500 in purchases. So, be sure to factor that into your estimates for groceries/amazon/gas etc…

It really all depends on how much you’re spending on gas.

BTW, this is hidden in the terms and conditions here at the bottom of the page: https://www.discover.com/credit-cards/student/chrome-card.html

Good luck!

Awesome thanks!

Great post! I learned something new and interesting, which I also happen to cover on my blog. It would be great to get some feedback from those who share the same interest about Cosmetic Treatment, here is my website UQ8 Thank you!