I’ve been frustrated for awhile with a certain aspect of my savings. And just a few weeks ago, I switched to Ally Bank and now my problems have totally gone away.

I know that sounds super gimmicky and something a super sleazy sales guy would say. But Ally isn’t paying me a dime to write this article and I don’t receive anything for doing it.

I just seriously love their online savings account.

Here’s why:

- Top notch customer service

- No maintenance fees of any kind at all, ever

- 1% annual interest rate

- FDIC insured

- Mobile Deposit

- No minimum balance

Ally Bank is an online only bank. This means that they have a super low overhead and can pass those savings to us.

Sure 1% interest isn’t a ton, but it’s literally 100 times more than the 0.01% I was getting at my local bank here in Chattanooga.

Also, if you search around online, you’ll find that 1% is at the top of the industry for online banks like Ally, Discover, Capital One, and Barclay.

In fact, I recently banked online with Discover and really had a great experience. However, I still decided to leave and switch to Ally.

And there’s 1 reason I decided to make the switch.

Ally Makes It Super Easy To Use Separate Accounts

That’s it.

They let me group my money into different accounts based on what I’m savings for.

Let me explain.

My wife and I have an “Emergency Fund” that we keep in an FDIC insured savings account. This emergency fund is a few months of living expenses and it’s only to be used in a real emergency (hence the name).

We also have other savings goals. We save for things like vacations, Christmas presents, a new puppy, a Go-Pro, a new car, a house downpayment, and lots of other things.

Sometimes it takes us a few months or even a year to save for these types of purchases. And the timeline is too short to put that money in the stock market. So instead, we like to put it in savings so that it can, at least, earn 1%.

But here’s the thing. I HATE putting that money into the same account as my emergency fund money.

That gets super confusing.

I really want to be able to separate everything out so that I can see my progress.

There’s also one other huge benefit to separating your money.

You’re Forced To Think Really Hard Before You Spend It

So let’s say you’re saving for a big trip to Chile this year. And you put all of that money that you’re saving into an account called “My Trip To Chile.”

You create a budget for all of your spending and for how much you want to save each week for your Chile trip.

What happens when you run out of normal spending money, but your friends try and get you to go out for drinks again this weekend?

Well, now you’re forced to make a decision.

You can either not go out.

Or, take money out of your Chile fund so you can go out again.

This is absolutely HUGE.

There is a major psychological barrier now that forces you to choose one over the other. And when you keep the money separate like this you’re much more likely to actually save the money for your trip.

This Is Why I Love Ally

Ally knows how helpful this is, so they make it super easy to open as many accounts as you want to and integrate them together.

Ally lets you open up to 25 different savings accounts and then puts them all together in one nice dashboard.

You’re able to log in with one username and one password and view all of your accounts easily and quickly. And because there isn’t a minimum balance requirement like most banks, you’ll earn 1% on your money regardless of how much is in each individual account!

I know this sounds like a no-brainer for companies.

I’ve been wondering why more and more banks aren’t allowing you to do this. But for some reason, Ally is only 1 of 2 banks that I know of that allow you to do this AND have the highest interest rates around.

How To Open An Ally Savings Account

So now you know why I love Ally and why I think you should too.

Next I want to show you how to actually open an account with them. Like I said, I just recently went through this entire process and I took pictures the whole time so that I could walk you through it too.

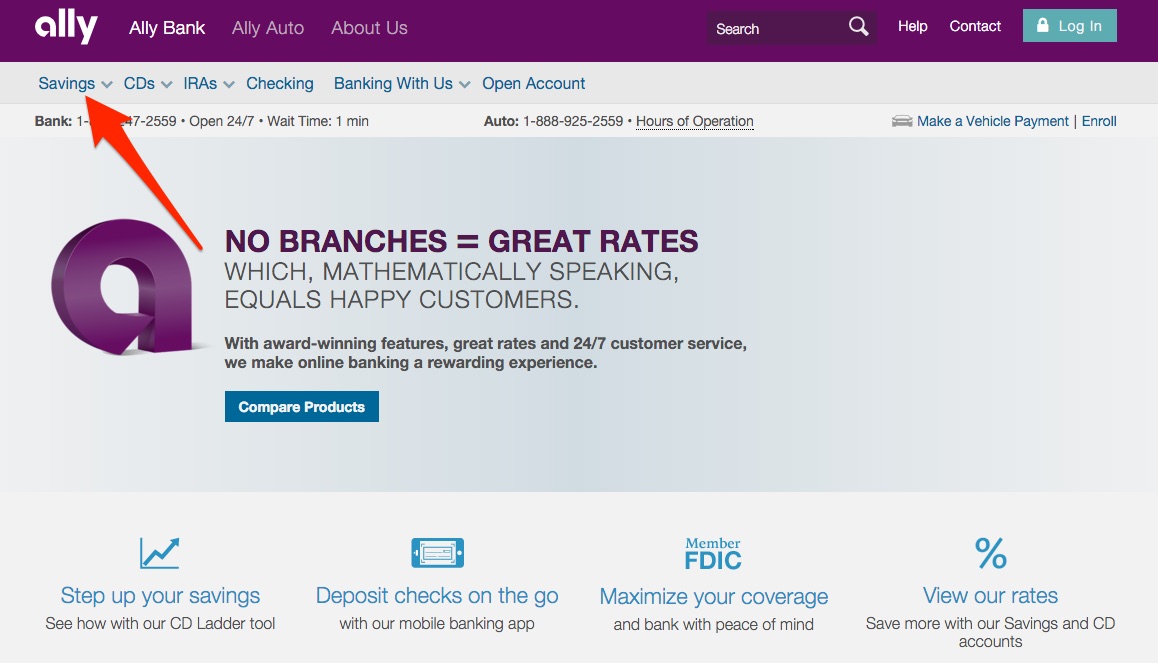

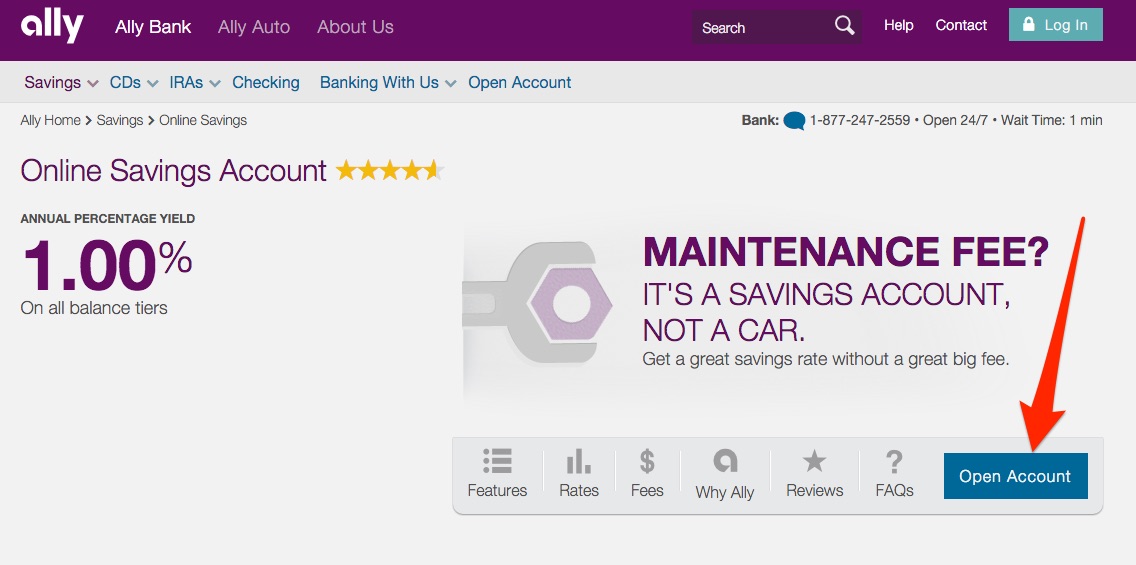

Step Number 1: Go To The Website

Go to Ally.com and click on “Savings”

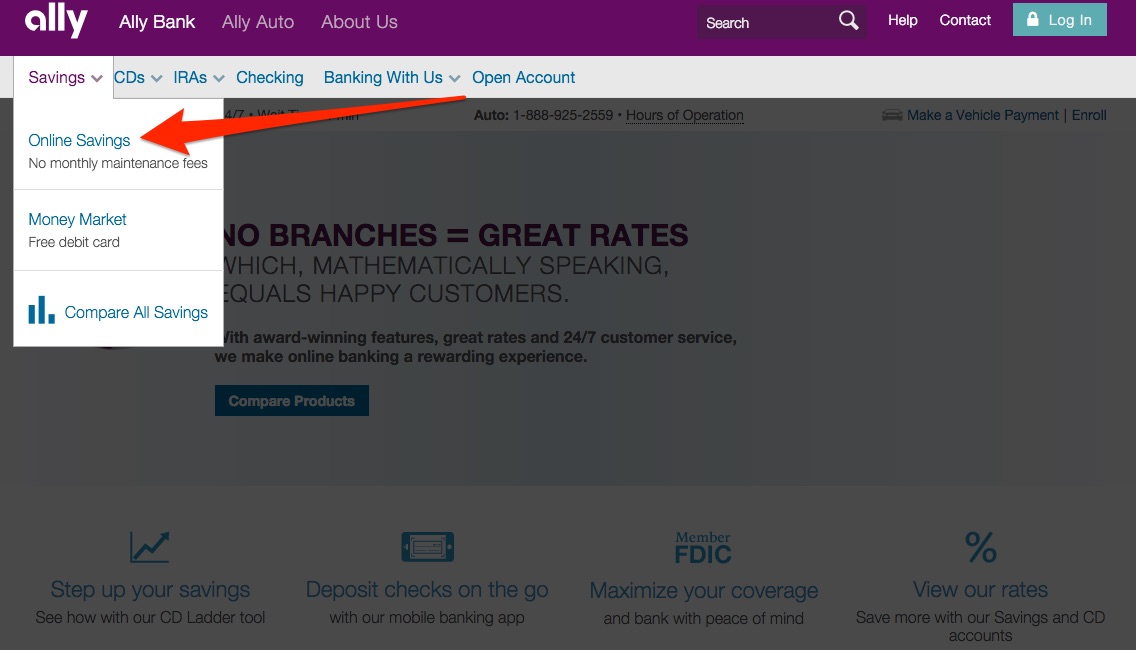

Choose “Online Savings”

At this point, you should scroll down the next page and read about the account that you’re opening. I truly think it’s the best out there and it’s what I personally use, but you should check it out for yourself.

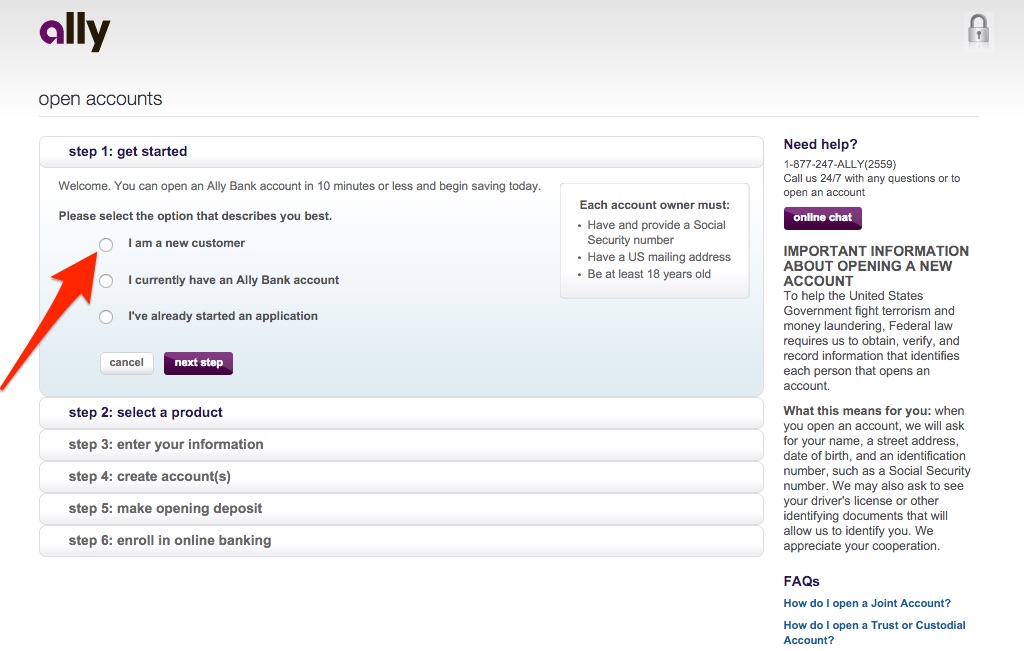

Step Number 2: Fill Out The Application

The online application is super easy. It only took my a few minutes and I was taking screenshots and drawing super cool arrows the whole time!

Get your personal information like birthday, social security #, and bank information together and you’ll be good to go.

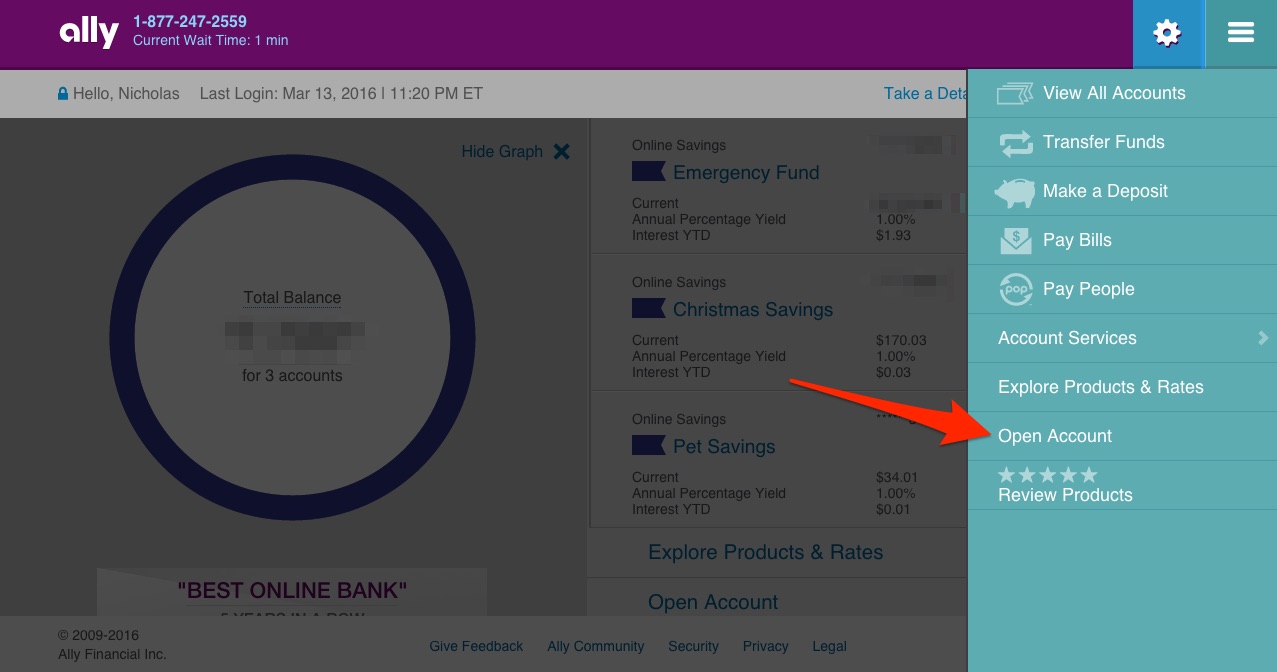

First click “Open Account”

Select “I am a new customer” and then press next step

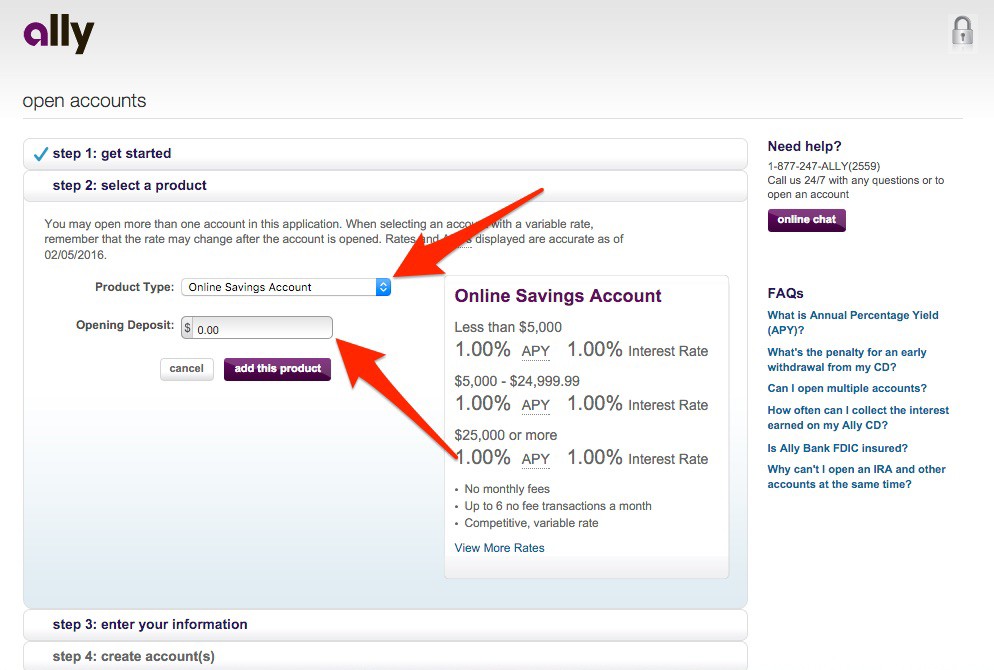

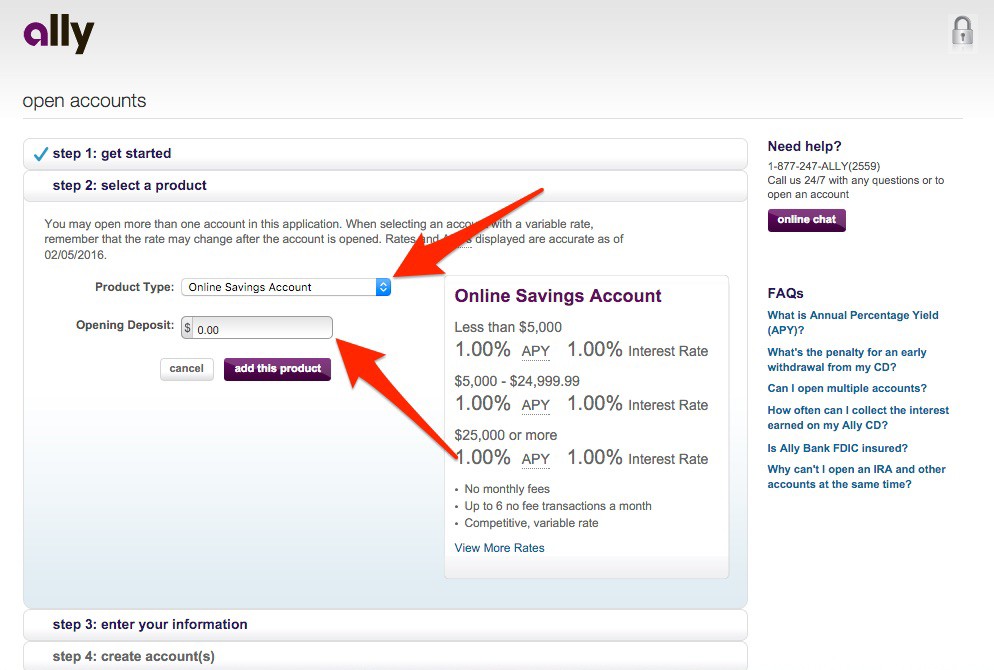

Select “Online Savings Account” and then enter the amount of money you would like to deposit and click “add this product”

Select “Online Savings Account” and then enter the amount of money you would like to deposit and click “add this product”

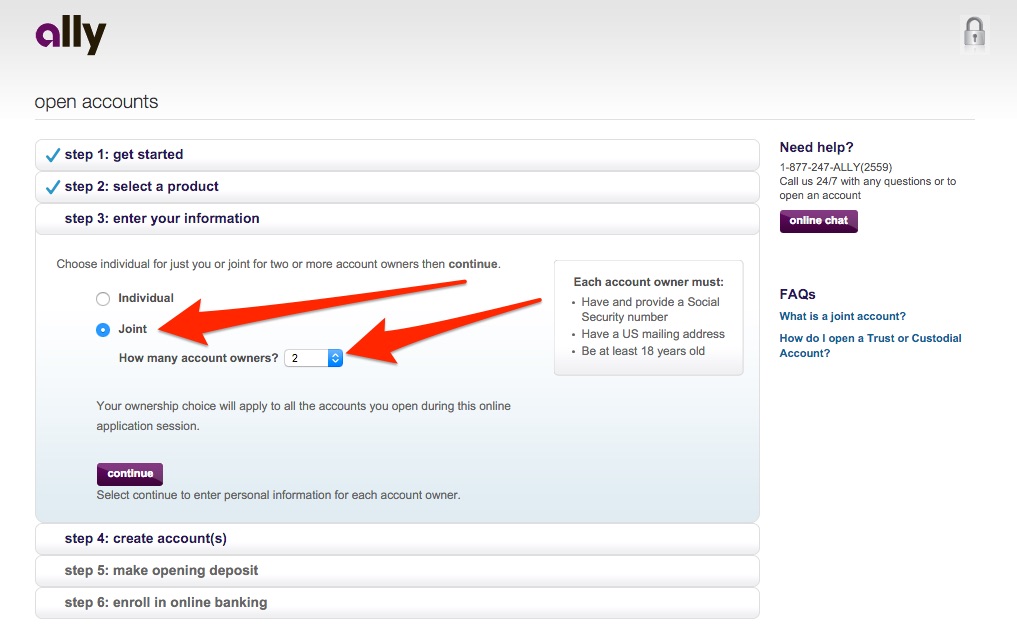

Next select whether this is a joint or individual account. I wanted Hanna to be on the account with me so I selected the Joint option.

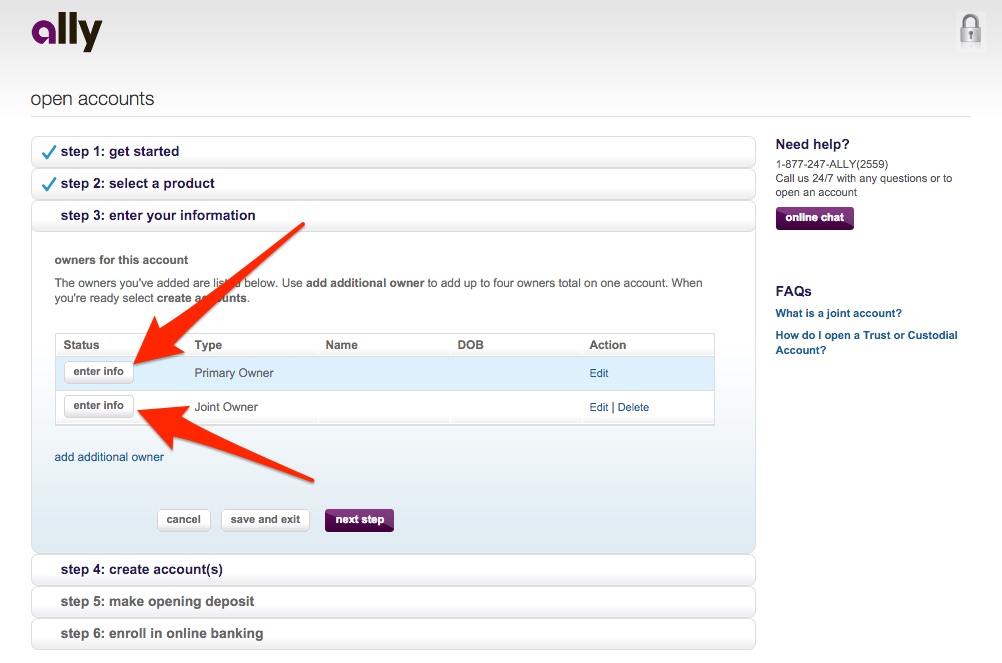

Then you’ll be asked to enter the personal information for everyone on the account.

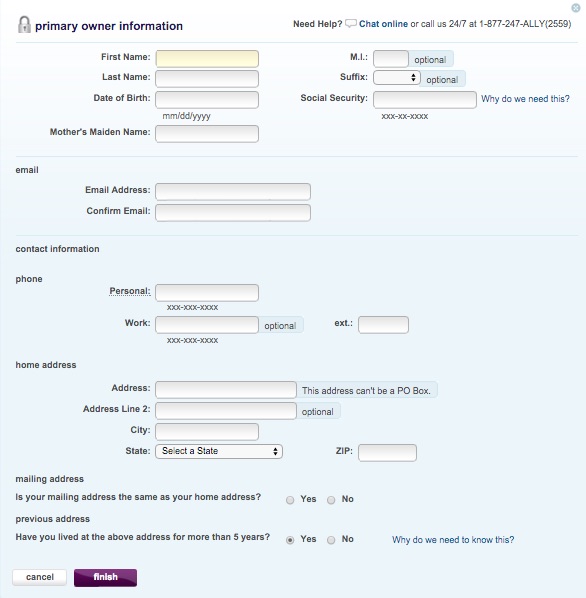

You’ll be asked normal information that you would need for opening any type of financial account. They need things like names, birthdays, social security numbers, and contact information.

Don’t worry, their site is secure and you are safe using them.

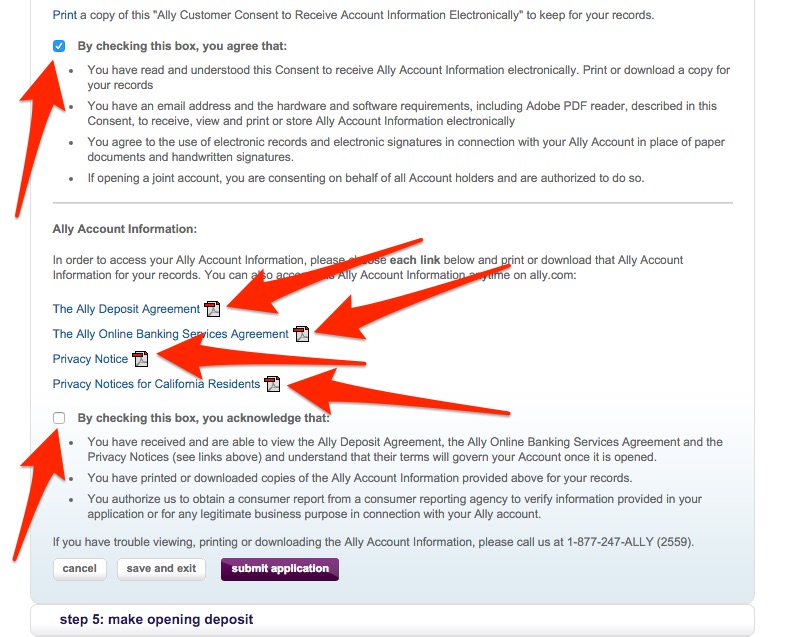

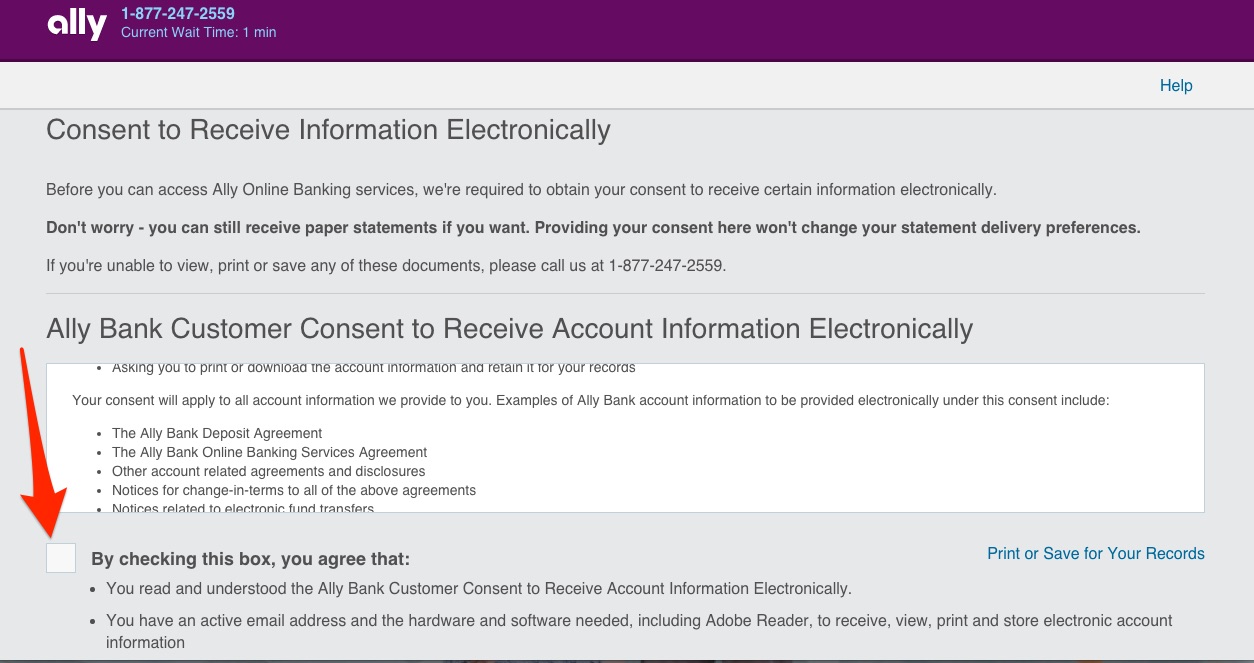

After entering information for everyone, you will be taken to the terms and conditions page.

Ally will have you check the box that you agree to their terms and give you the option to download all of the terms and conditions from them. You should go ahead and do this and store it somewhere safe on your computer.

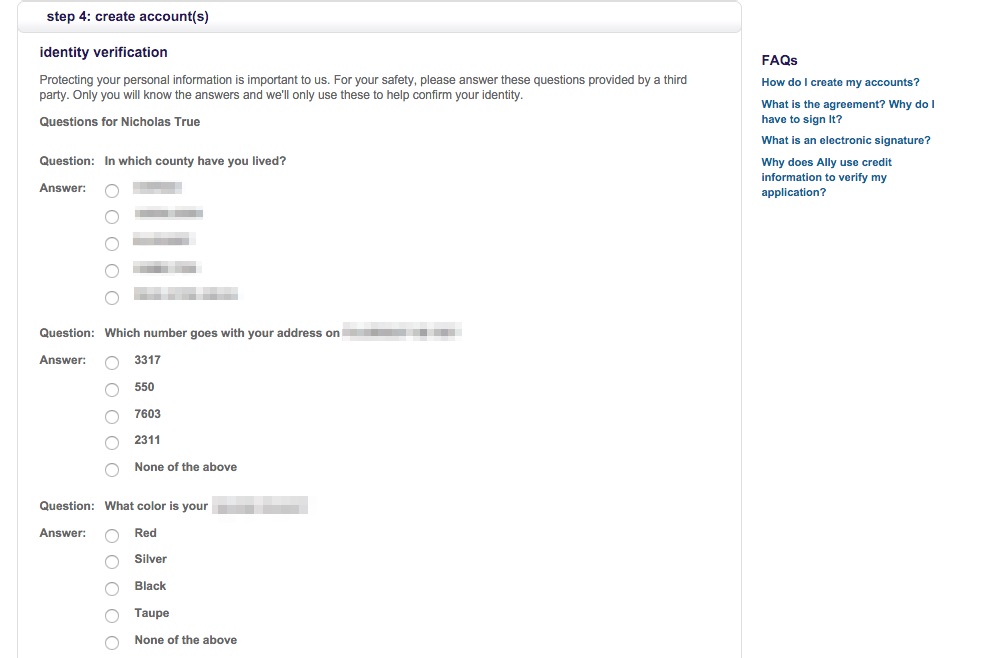

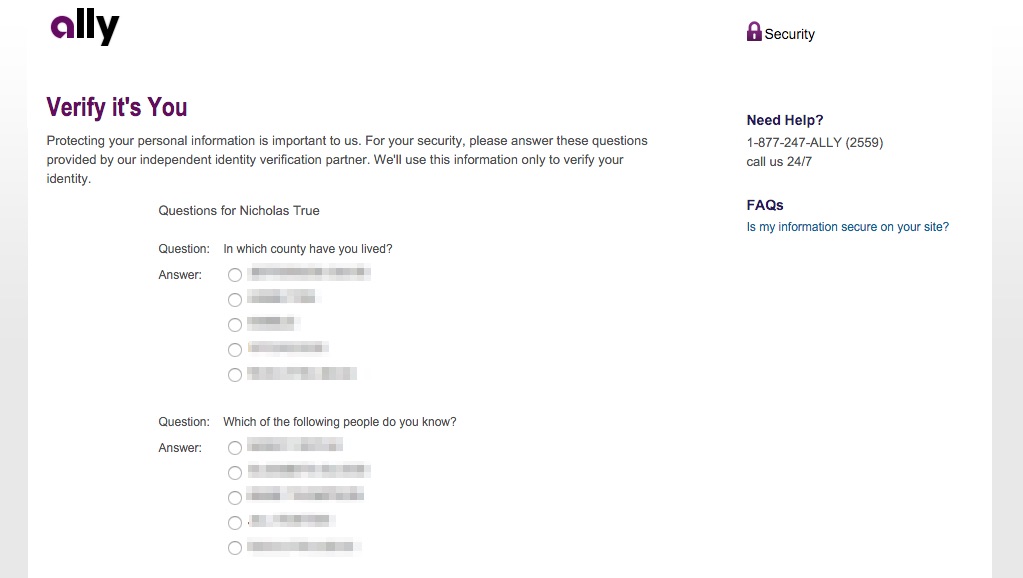

After accepting the terms and submitting the application, you will need to verify your identity by answering a few personal questions.

These questions will typically be about places you’ve lived, people you’re related to, or types of finance accounts that you may have in your name.

Just answer them honestly and then submit the verification.

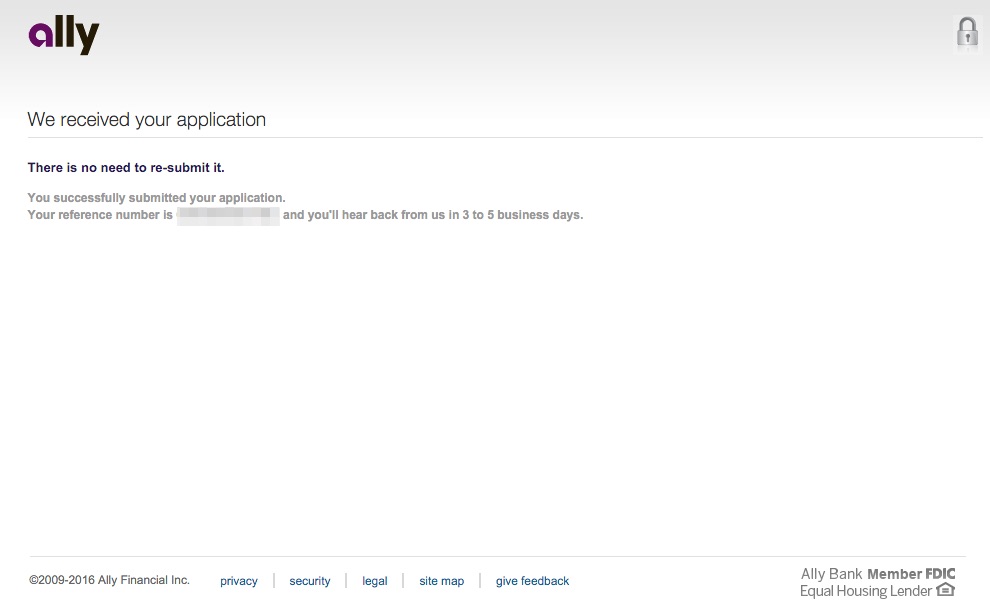

If this is your first Ally account you will see this screen next.

At first, I was confused.

I thought that I would be able to set everything up online right then. Unfortunately because it is a financial account, Ally needs a few days to process the application and verify that it is actually you.

So don’t be upset. They do this for your protection.

I received a phone call about 2 days later that was just once again asking me to confirm that I wanted to open the account and that I was actually Nick True.

Again, with all of the identity theft going on nowadays, I was actually happy to wait and it made me feel good knowing that they are doing everything they can to protect me from identity theft.

Step Number 3: Receive Welcome Kit

A few days after the phone call I received this in the mail.

This package is my welcome kit from Ally and had more information about the savings account.

The main thing you need to do now is open the package and find the signature cards. Ally sends a signature verification card that you must sign and then mail back to them.

Don’t worry they include an envelope with free postage. So all you need to do is sign the card, put it in the free envelope, and stick it in the mailbox.

Once again, they make it all super easy.

Step Number 4: Create Online Account

You don’t have to wait for the signature cards to arrive. Once you’ve got your packet, you’re ready to open up your online account and transfer money to it.

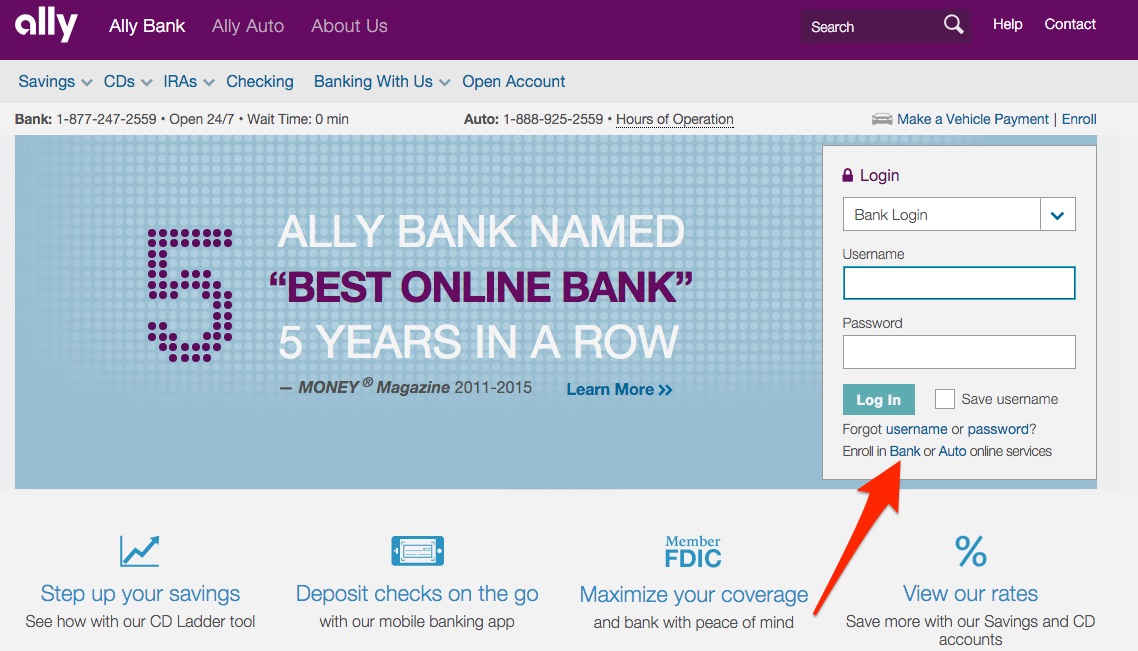

First go back to Ally.com and then choose “Enroll in Bank Online Services”

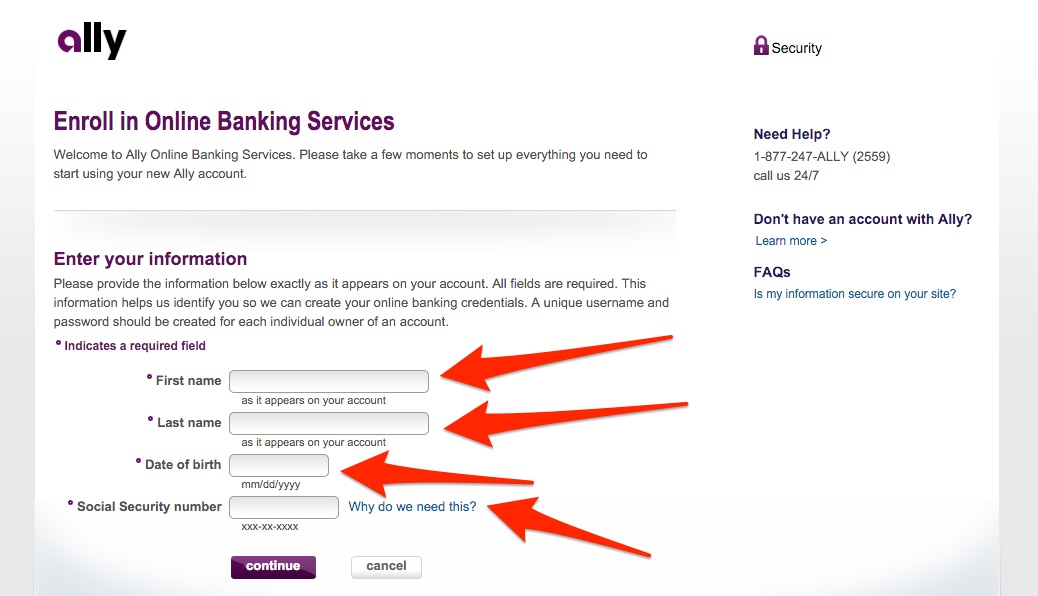

Next you’ll enter your information so Ally can find your account.

You’ll need to verify your identity again.

I know, I know, it’s like you’re asking to access stuff even Hilary Clinton doesn’t have access too.

But for real, it’s for your own good.

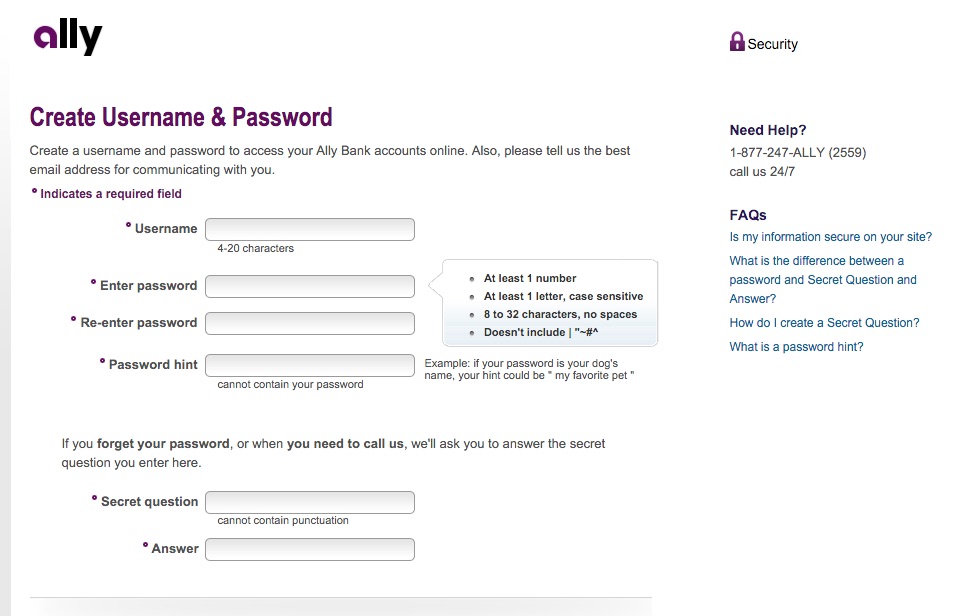

After that, you can finally set up a username and password.

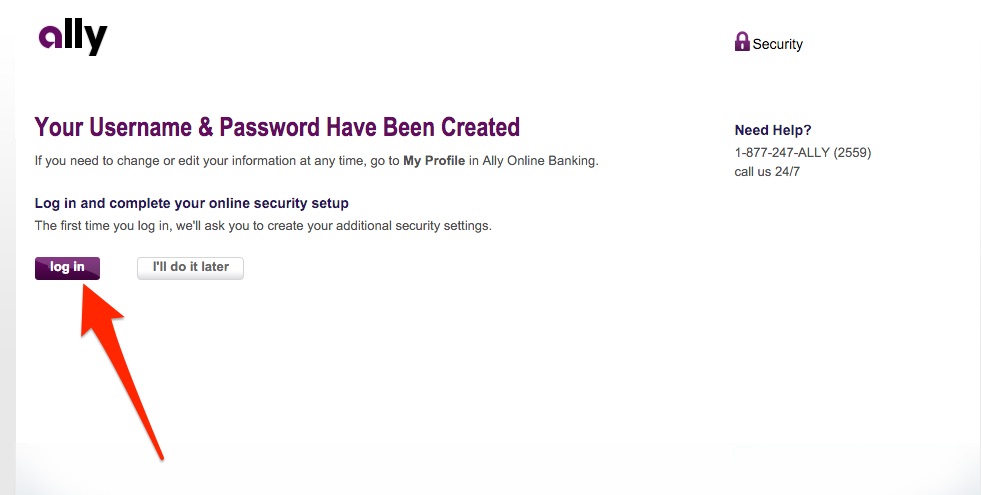

Once you’ve done that, you can now log in with your newly created credinitials!

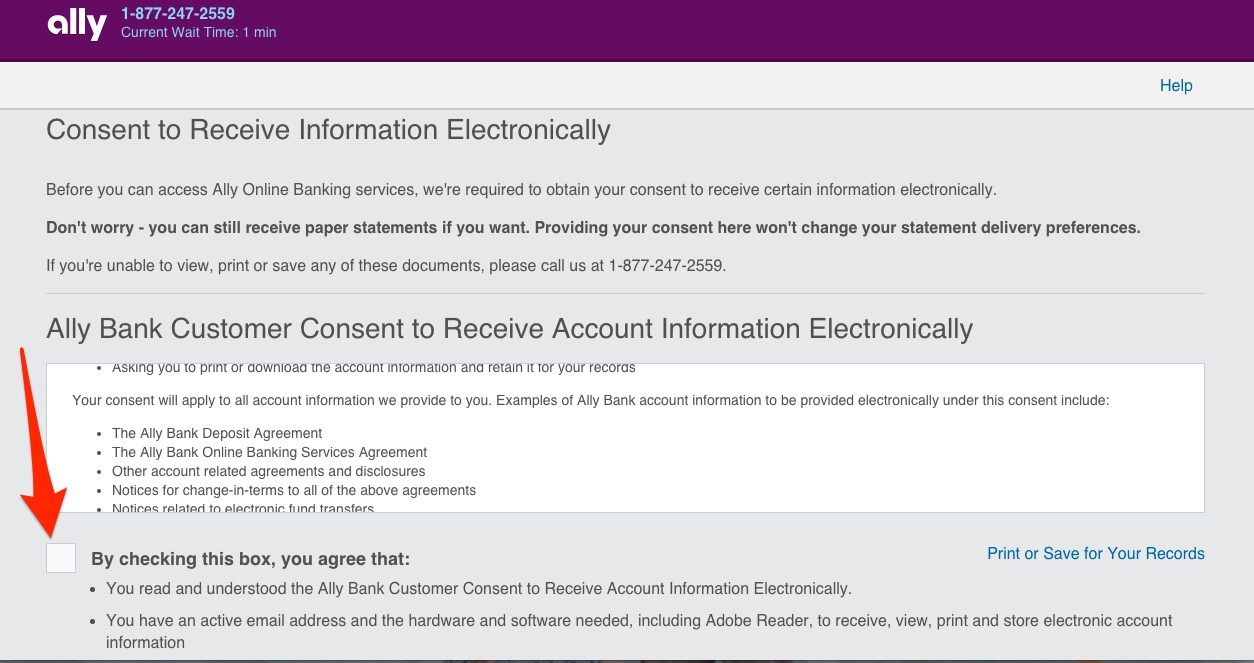

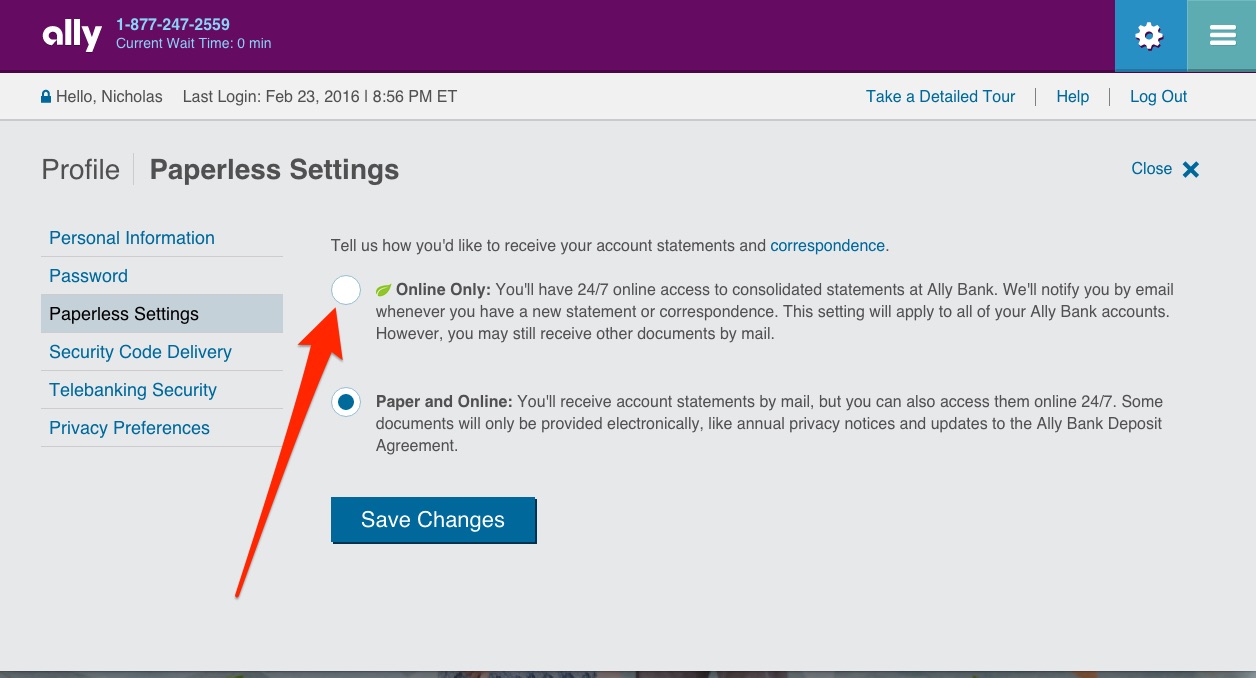

After you log in you will immediately want to sign up for receiving everything electronically. This way Ally will just shoot you an email every month with your statement and you can access everything easily online.

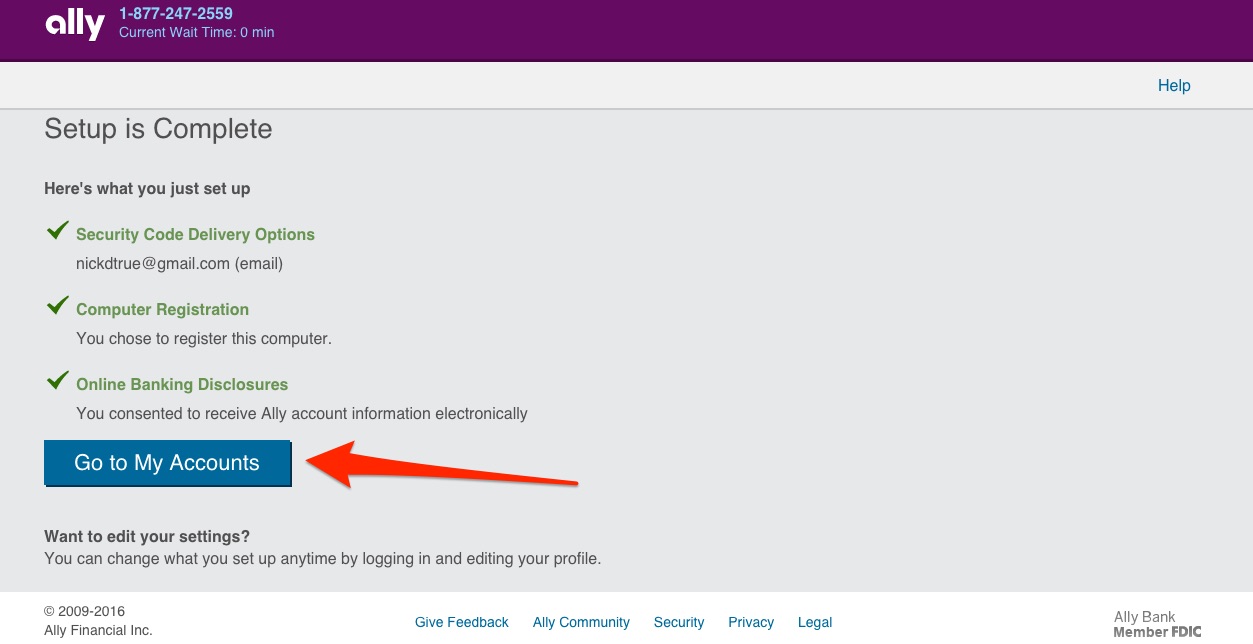

Yay! Setup is now complete!

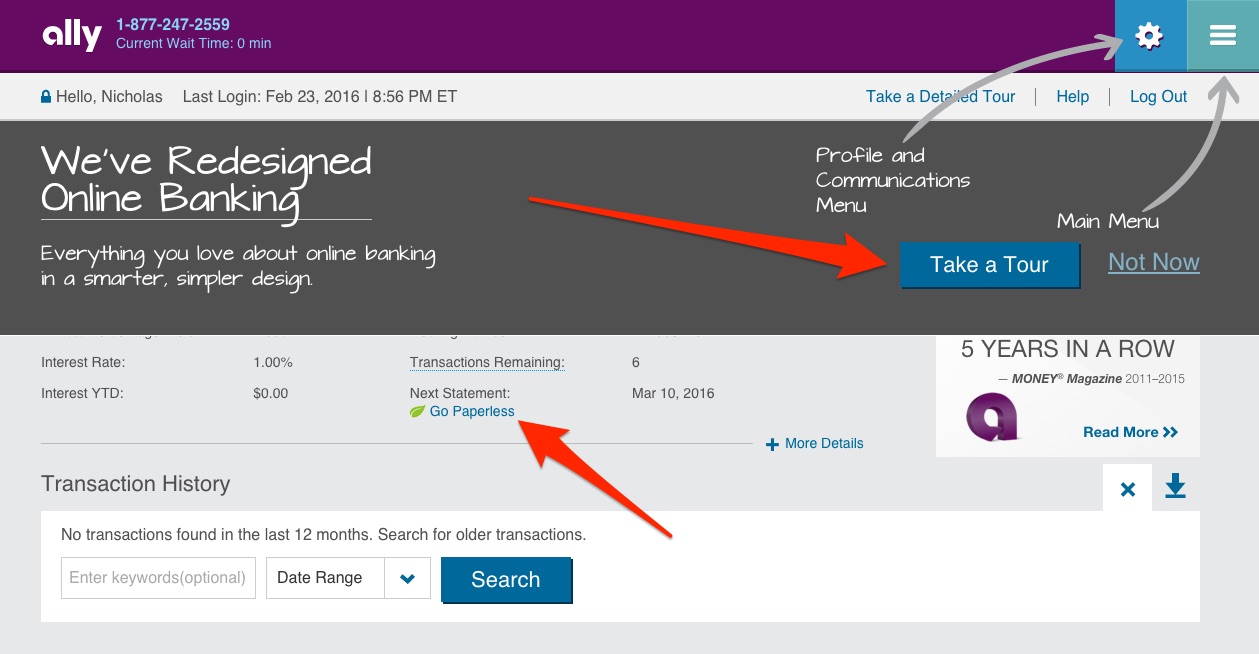

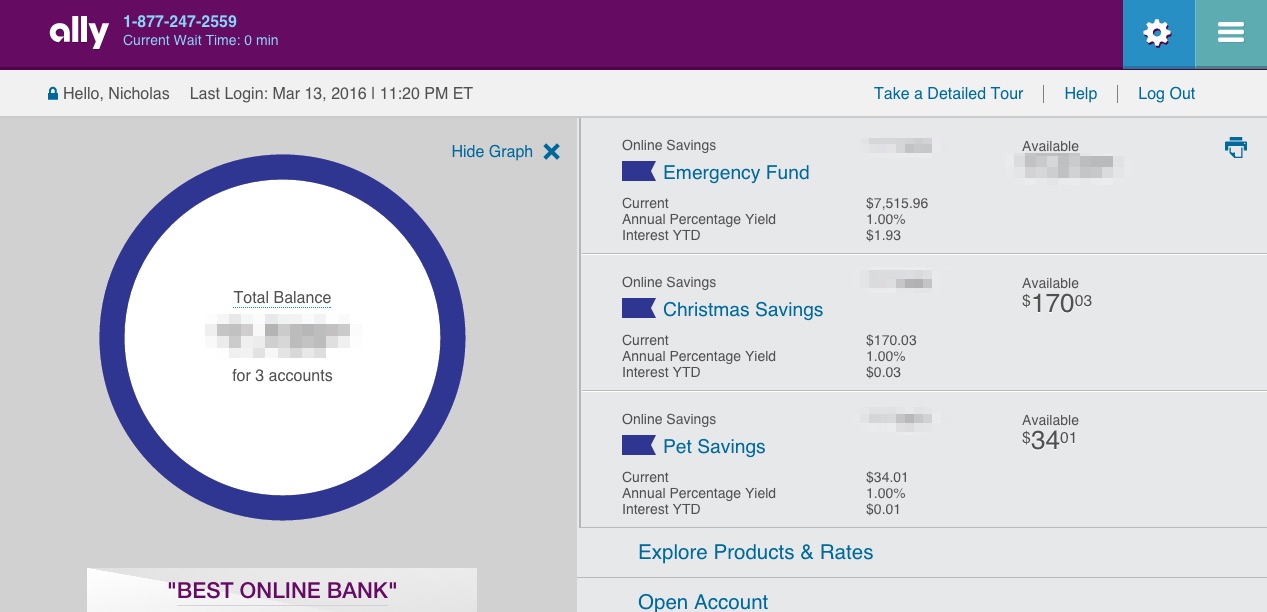

Here is your new Ally bank dashboard and this is where you will eventually see all of your accounts (if you choose to open more).

I would first take a tour and let Ally show you around the dashboard.

Then I would make sure again that you’re enrolled in paperless statements.

Step Number 5: Name Account and Make Your First Transfer

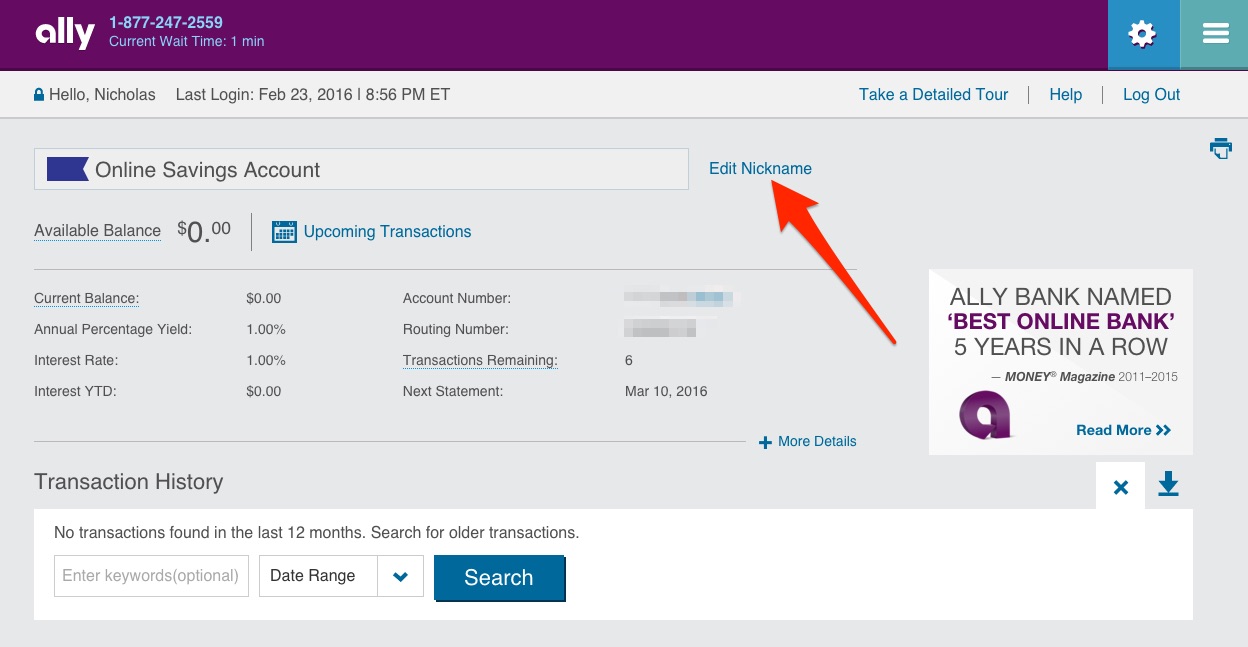

Next you want to give your new account a nickname! I chose “Emergency Fund” for my first one, but you can choose whatever you like.

After you give your account a nickname, you’ll want to transfer money to your new Ally savings account.

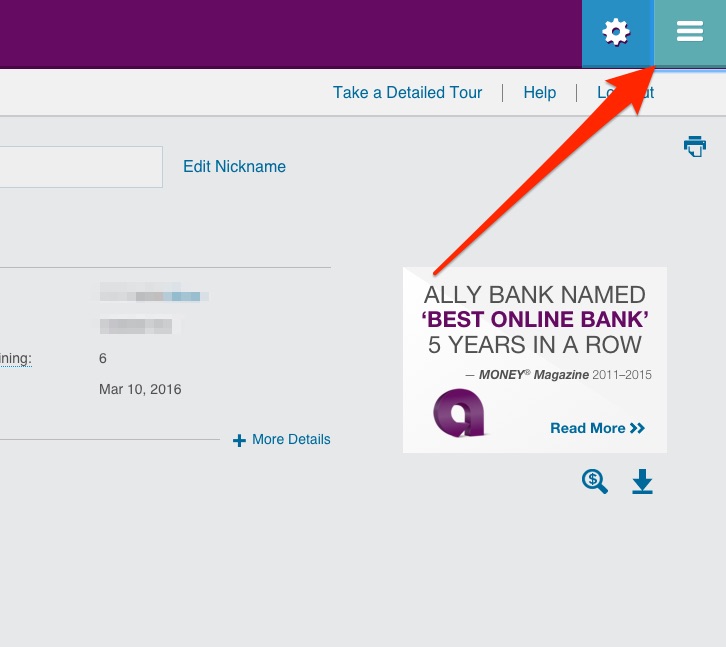

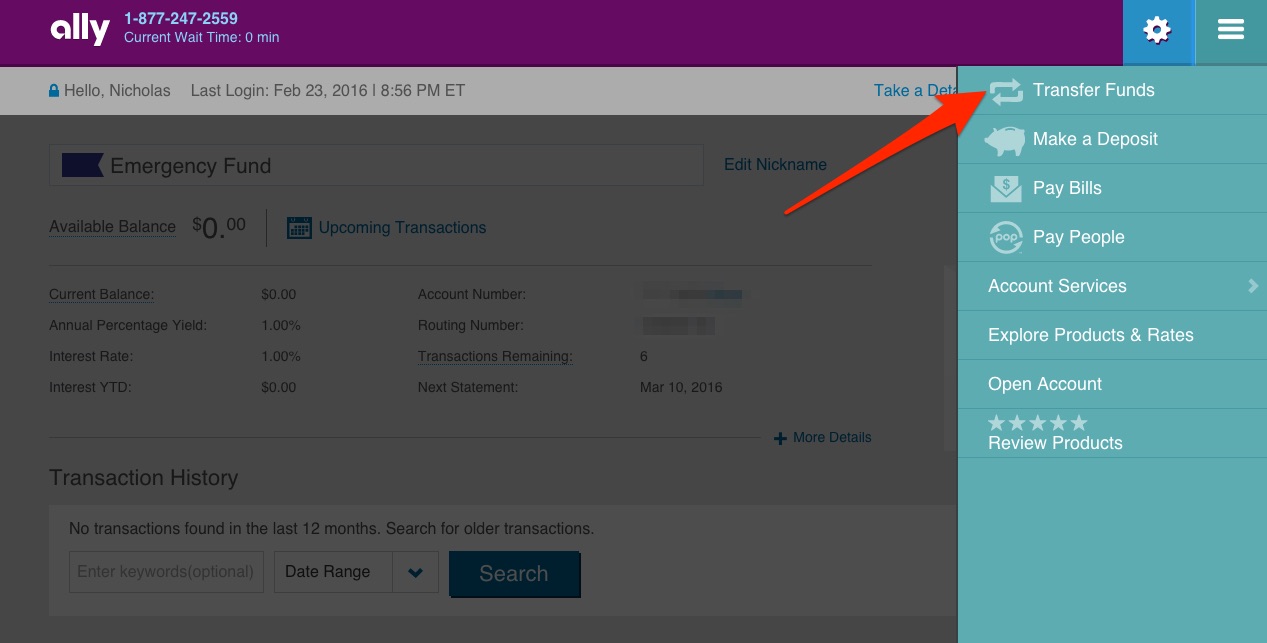

Start by pressing the menu navigation button in the top right-hand corner.

Choose “Transfer Funds”

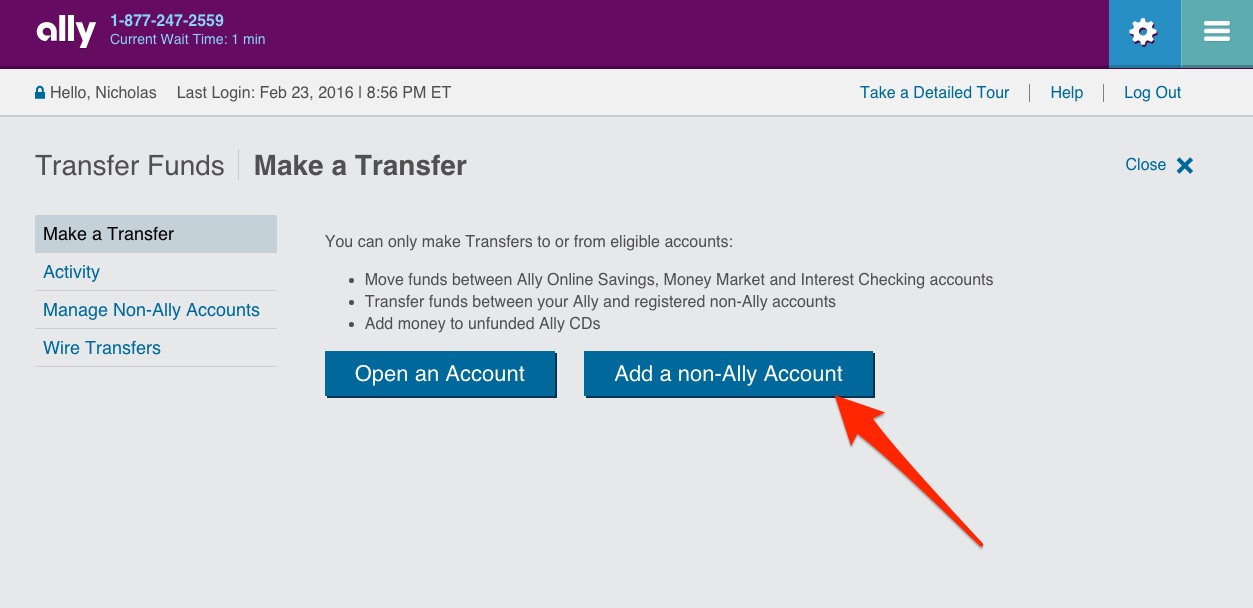

If you already have an online checking or savings account with Ally you can choose that option now. But I don’t, so I am going to trasnfer money from my checking account at a local bank.

I wanted to be able to trasnfer money back and forth between my new Ally Savings account and my local bank here at home.

You could just make a single deposit with a check but I knew that I would be sending money back and forth in the future, so I wanted to go ahead and link the accounts.

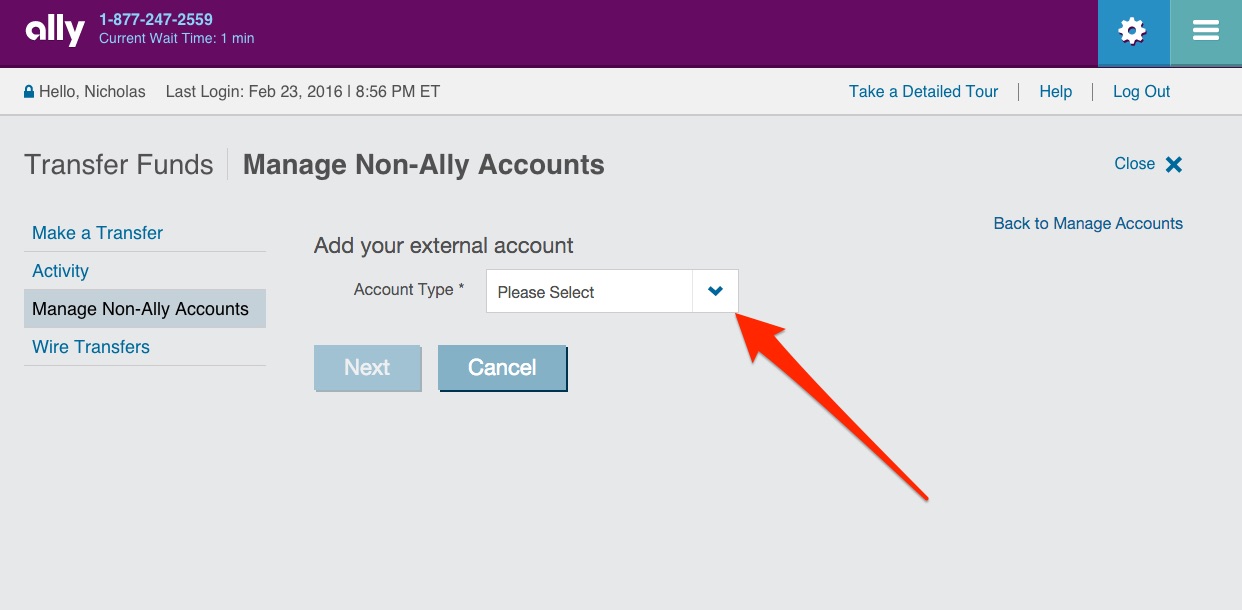

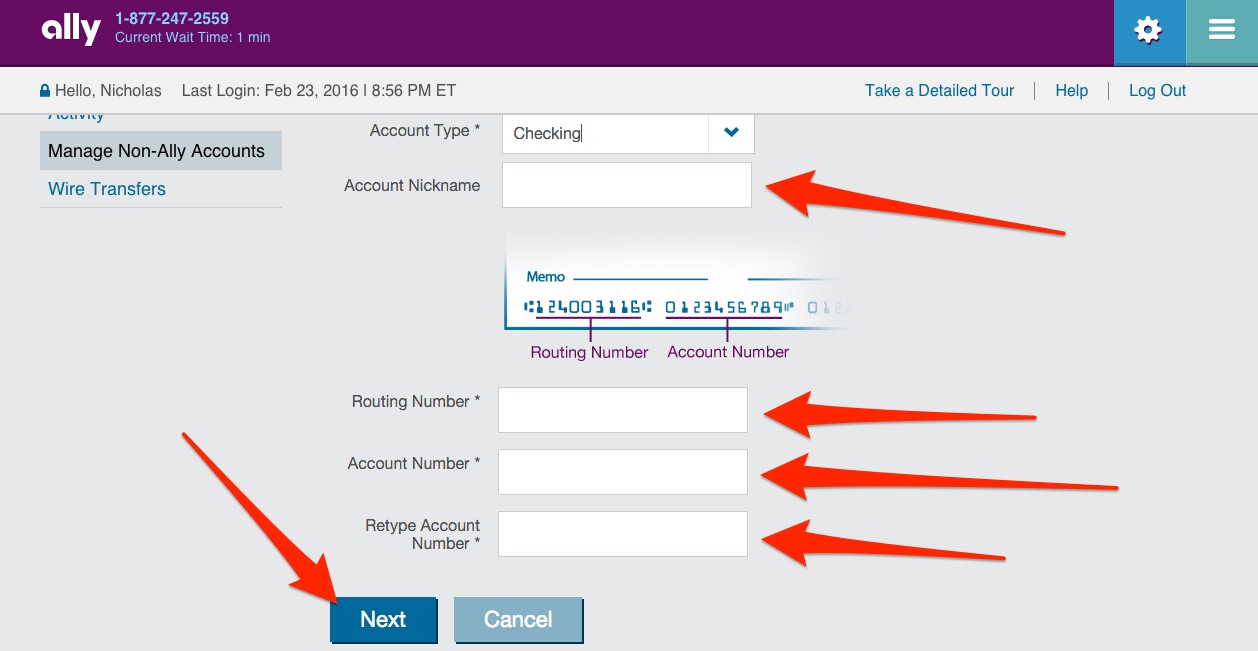

If you want to do the same choose “checking” in the drop down on the next page.

Then you can input your bank information link bank routing number and account number.

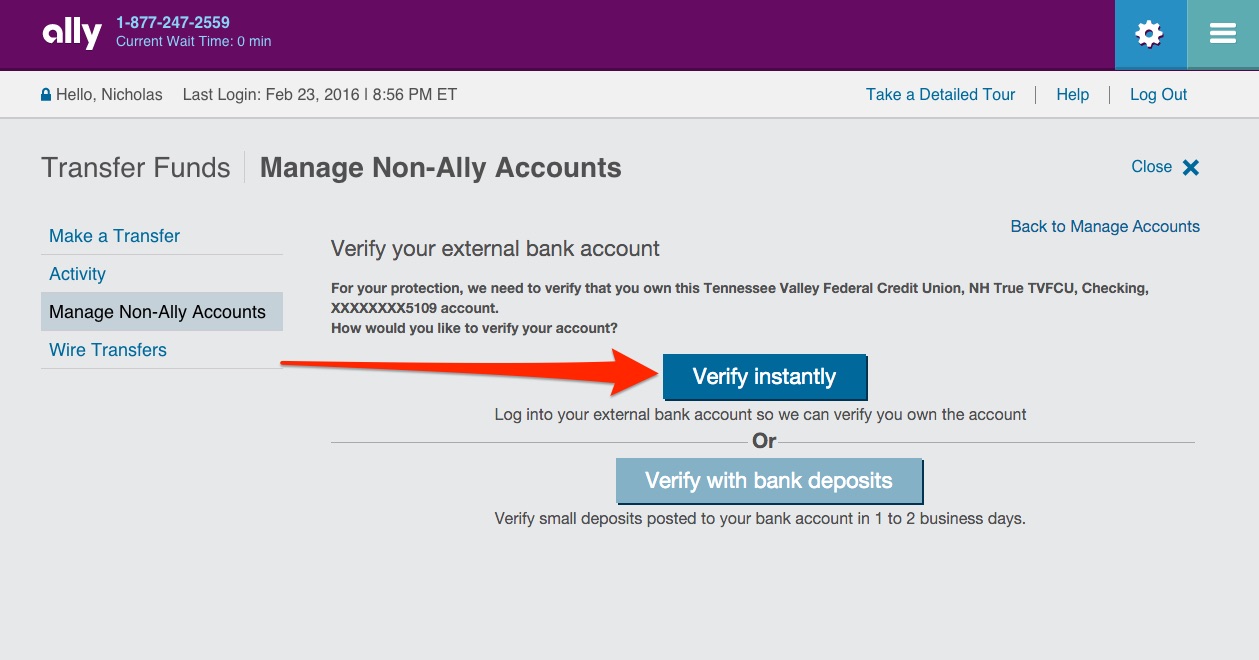

Next you’ll need to verify the account.

If you have online access to your checkign account you can choose to “verify instantly”.

If you don’t want to do that, or don’t have access you will need to choose “verify with bank deposits”

I went ahead and chose to verify instantly so that I could get going right away.

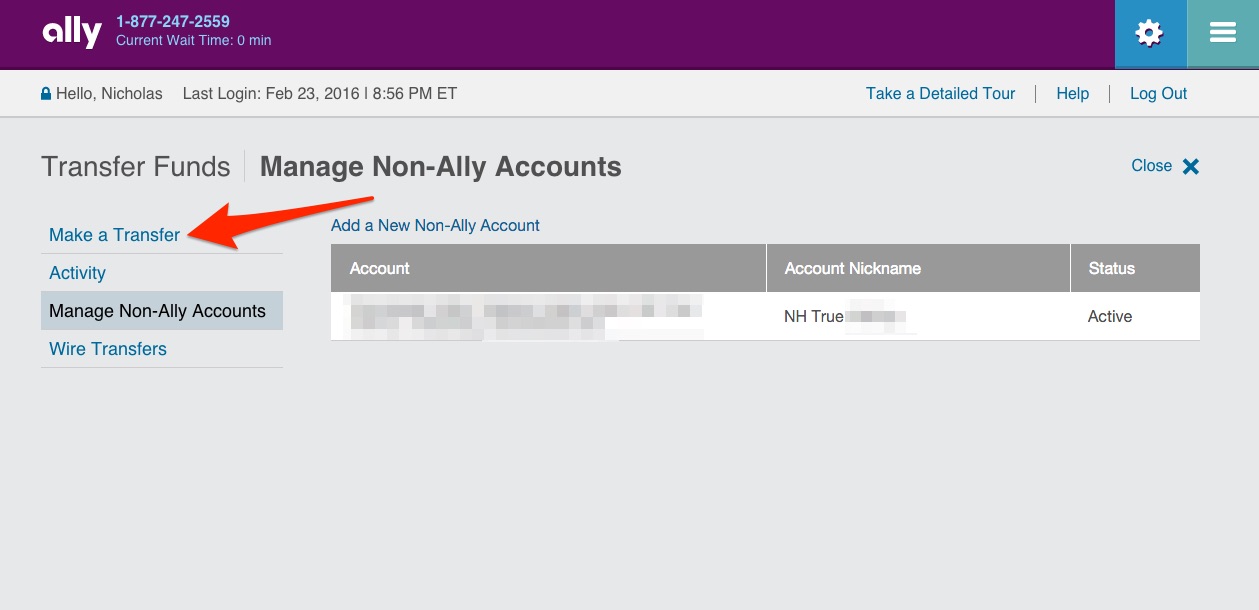

After the account is verified, you can make a transfer to your new Ally Savings Account.

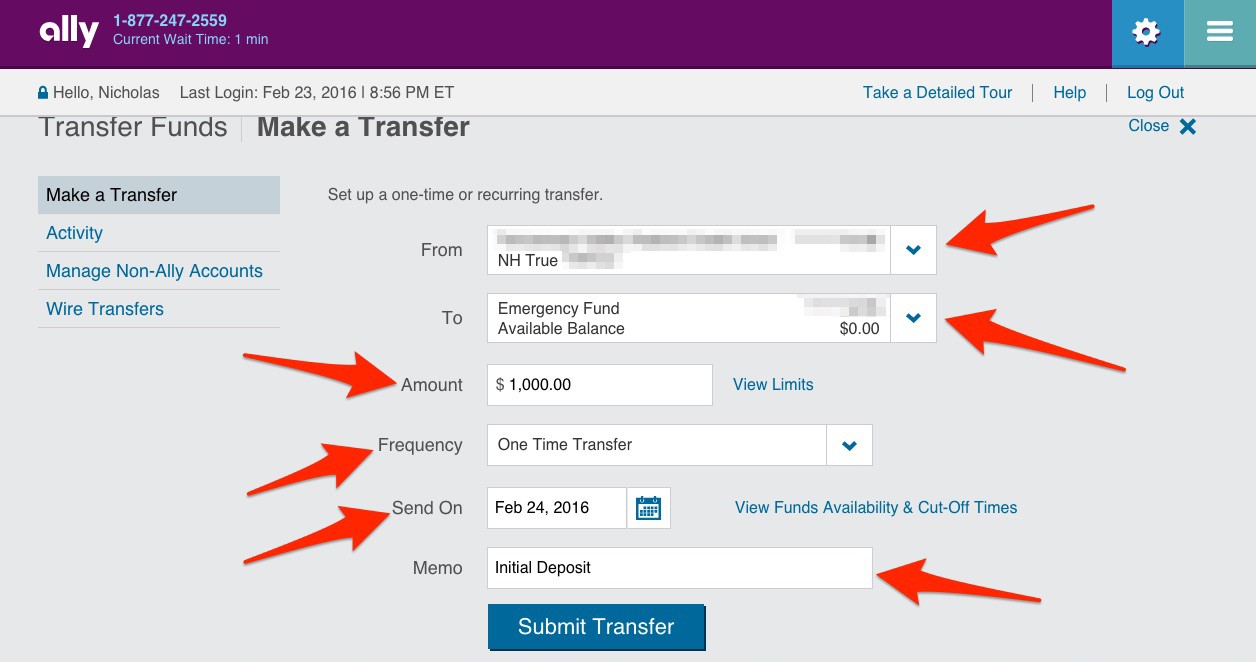

Just select the checking account as your “from” and your new Ally account as the “To.”

Then you can choose the amount you want to transfer and what date you want to transfer.

And that’s it.

You’re all set up with your very first account.

If you only want one Ally savings account you can stop here. Enjoy the high-interest rates and the super easy to use platform.

But if you’re like me and you want to have multiple accounts to separate your savings, then there’s one more step.

Step Number 6: Set Up Multiple Accounts

All you need to do from here is login to your account and choose “Open Account”

You’ll now be taken to the exact same application that you filled out in Step Number 2 above.

Fill out the application just like normal, except with two differences.

- You can open up multiple accounts at a time if you want.

- You can go ahead and make deposits if you want.

I chose to open up 2 more accounts. I wanted to have a Christmas savings and a Pet savings.

My wife and I like to send a certain amount of money every month to our savings for Christmas. That way when Christmas time comes we already have enough money to cover presents, decorations, and other Christmasy stuff.

We’re also currently saving for a puppy. Plus we like to have an account where we save money for unexpected pet bills like shots, sickness, vet visits etc…

So you can go ahead and set up multiple accounts right from the start. When you get to the “select a product step” just keep adding savings accounts “products” until you get as many as you need.

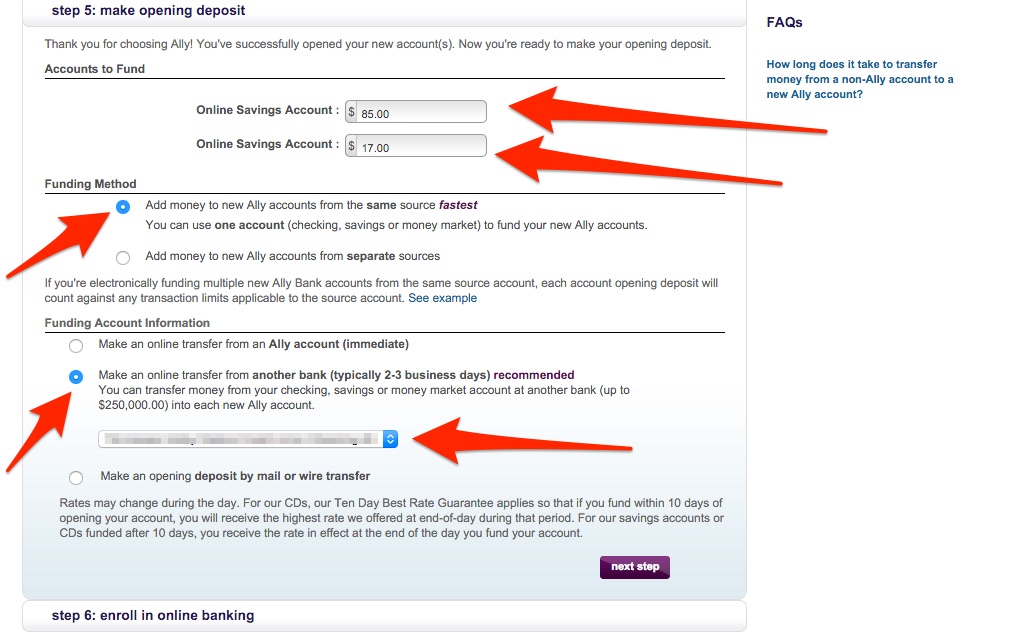

The other difference between now and the first time is that you can go ahead and make deposits.

Now that you are already a verified Ally user and have an account, you won’t have to wait for a phone call to set up the accounts and make your first deposit.

When you get to section 5 of the application you can input how much you want to deposit to each account that you’re opening. You can see below that I’m starting with $85 for my first savings account and $17 for the other one.

Just put how much you want to deposit and then choose the checking account you already set up.

Once you finish the application just choose “next step” and you’ll be taken to the terms and agreement screen again. Accept these terms and then you’re done.

Step Number 7: Enjoy Your New Ally Dashboard

Once the set up is complete you can login to your account using the same login you created earlier.

You can change the names of each account to suit your own preference. And the great thing is, the names don’t always have to stay that way.

You can start out with “Trip to Chile” and then after the trip is over go back and rename that savings account to your next savings goal!

Check out the image below for what your home screen looks like with multiple accounts.

Your home screen shows you a total balance for all three accounts and the individual breakdown of each account.

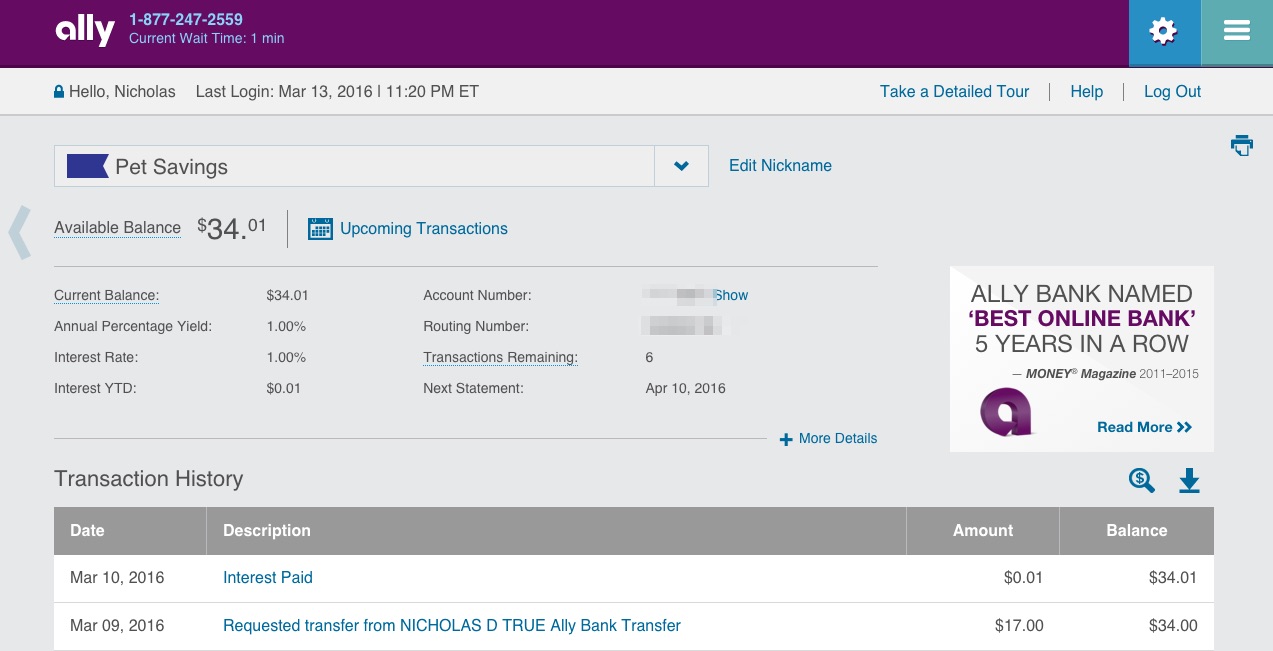

If you want to, you can click on each account to see the specific details of that account.

This is what my Pet Savings looks like.

So that’s how you set up your online savings account with Ally bank.

I Love The Ally Savings Account

And I think you will too.

If you have any more questions about Ally, please leave a comment below and I’ll be sure to answer.

I’ve really enjoyed using them and I hope you do too.

If you found this helpful, please use the buttons below to share with your friends who might want help setting up an online savings account too!

Hi, I wanted to ask if when Ally called did they ask you to send them a copy of your driver’s license to help verify your address?

Yes I believe they did. I scanned the drivers license and emailed it to them.

But if that’s a problem, you can ask them if there’s another way and they will sometimes allow you to send a utility bill or other form of proof of residency.

Good luck Kallita! 🙂

Opening a savings account is a necessity these days and it brings many benefits.

All the comments given have given me support too.

Thank You.

Nick, I also have Ally Bank Savings, Money Market and 11 month no-penalty CDs. I started with Ally about 5 years ago and have always been pleased with their customer service and online facilities.

I began with Ally Bank because they had higher yields than many competitors at the time. Also, because their penalty for early withdrawal from their various term CDs was only 2 month interest. Thus, you could purchase a longer term CD, for example, 5 year, get a higher yield and generally come out way ahead if you had to terminate the CD after 6 months or so compared to the lower yields on their shorter term 6 month, 1 year, etc. CDs.

Ally has since increased their penalty for early withdrawal on their longer term CDs making the above strategy less beneficial. Ally also seems to be lagging a bit behind more competitors on the yield they pay on various products. Thus, I have begun to split my online accounts between Ally and CIT Bank.

At this time, 3/20/2018, CIT Bank is paying 1.75% on their MM Account vs. Ally Bank 0.90% for balances under $25K or 1.00% for balances of at least $25K on their MM Account, or 1.45% on their savings account of any balance. Also, CIT Bank’s 11 month no-penalty CD, minimum of $1K, pays 1.85% versus Ally Bank’s 11 month no-penalty CD paying 1.15% on CDs under $5K, 1.25% between $5K and $25K and 1.50% on CDs of at least $25K.

I haven’t had a need to for multiple separate savings accounts for the type of purposes you illustrate, but I suspect the same multiple account approach can be set up at most online banks.

Nice Ron! I’m glad you’ve enjoyed Ally. At this time, I don’t have high enough balances that it’s been worth my time to try and find an account with 0.1 – 0.4% better interest. But I didn’t realize that about CIT bank, that’s definitely good to know. As far as multiple savings account, I’m a huge fan of this. And I’ve looked around at a bunch of different online banks and few of them (at the time I was looking) would let you open multiple accounts and actually change the names of them.

When I left Discover 2 years ago, that was the main reason I left. I’ve really enjoyed naming the accounts specific to what I’m saving for.

That’s super interesting about your CD strategy. Again, I haven’t really invested in CDs recently because the gain has only been marginally better than a purely liquid savings account, so I’ve stayed there.

But, as interest rates continue to rise, this is something I should probably pay more attention to.

Thanks for sharing Ron!

Nick, you are welcome. I’m a different situation than you.

I turn 76 on Friday and have been watching a 55+ community for a desirable resale. I’ve a bit over $400K that I’m keeping fairly liquid so I can buy without having contingency of needing to sell my current home to buy [ab all cash purchase]. Thus, I’m trying to earn as much as possible on a large sum without being looked into longer terms and potential penalties.

After purchase and sale of current home, I be back into my almost all equity asset allocation portfolio, keeping a $50K to $70K contingency fund, possibly in laddered CDs since early withdrawal penalties may not be as big a factor with money I not likely to access except in an extreme emergency.

I appreciate your articles. You write much better than I do. The articles are excellent starter advice I can extract and use with my grandchildren as I hope to progress them into building a money management and investment plan.

Love it Ron! This is so inspiring, and definitely the kind of position I want to be in when I’m your age. It 100% makes sense to chase small increases when you’re talking about $400K.

Your strategy makes complete sense to me. I’m glad you found my site and stopped by.

And thanks so much for complimenting the articles. It’s been a lot of fun and I certainly hope you can point your grandchildren in the right direction. It sounds like they have a lot to learn from you, hopefully, they’re good listeners!

Just wanted to say thanks for this detailed article. After hearing good things about Ally I just went to open a savings account and got to the “you’ll hear from us in 3-5 days.” Being that I’ve opened store specific credit cards online and shopped with them the same day I thought I must have been denied to open an account. Might sound dumb but it made me want to cry. Then I saw your article so I feel better now. 🙂

Hey Susan! So glad that the article was helpful for you 🙂

Yes, the wait time had me confused at first as well. But glad it gave you some peace of mind. Thanks for stopping by!

This post comes with a lot of details and I want to thank You for sharing it as it has been very helpful.

opening of account is its for nigeria?

his its for nigeria

This is what I exactly need, thanks nick

An impressive share!

Thanks, I’ve just been searching for information about this topic for a long time and yours is the best I have come upon so far.

But, I have more tips that best explain more about the Hallelujah Challenge Live 2023 and how to join freely and easily I'm happy that I found this in my hunt for something relating to this.

You won’t want to miss out.

IS IT POSSIBLE TO ACTUALLY GET BACK FUNDS LOST TO CRYPTOCURRENCY SCAM? ABSOLUTELY YES! BUT, YOU MUST CONTACT THE RIGHT AGENCY TO ACHIEVE THIS.

DARK WEB ONLINE HACKERS is a financial regulator, private investigation and funds recovery body. We specialize in cases concerning cryptocurrency, FAKE investment schemes and recovery scam.

Visit darkwebonlinehackers.com now to report your case or contact our support team via the contact information below to get started.

dwchzone@gmail.com

WhatsApp: +1 (803) 392-1735

Stay Safe !

Click here to know more about How to Buy an AirPods Max on Facebook Marketplace

I can’t lie, you have a very nice site. I am so glad to come across the information I found on your website.

I wish to express my gratitude for distributing such noteworthy information to the world. An African and Nigerian music download website is called Naijavibes.

Looking for a website to stream movies for free? kindly click on that link.

Don’t know how to make a LinkedIn business profile? Luckily, you have clicked on the right guide as we will be teaching how to make a LinkedIn business profile.

It no longer amazes me for the kind of articles you produce, they always leave me speechless. if you want to know more about Tubidy music kindly click this link

Waptrick music is one of the categories under the Waptrick website where you can access full collection of free mp3 music to your device. Without any doubt, for those of you who are familiar with Waptrick, Waptrick is known as a website where millions of users can download free mp3 files completely for free, Mp4 videos, Mp4 movies, Tv Series, Mobile apps, wallpapers, Java Games, Android games, and many more.

Are you looking for how to download any of your favorite mp3 music, videos, apps, games, mobile applications, and many more? Waptrick is just the answer to get access to downloading these mobile files without stress. Waptrick is a mobile wap portal that allows users to download amazing files with easy access. The website is mainly for mobile users with low storage devices. The official website – waptrick.com is of the popular mobile sites millions of users visit today to download their favorite mobile contents.

Waptrick is a popular website where you can download free java games, mp3 music, android games, mp3 & mp4 videos, themes, wallpapers, mobile apps, and many more. The waptrick website host millions of visitors on daily basis who visits the site and download their favorite media files. Apart from the listed media content mentioned above that you can download from Waptrick, there are other amazing media files you can access on this website. They include e-Books, Photo Gallery, Song Lyrics, TV series, Themes, and Horoscopes

Waptrick Mp3 Download is web portal on the Waptrick.com music download site where you download free Waptrick music and free mp3 songs or music. The music platform offers new and existing user’s access to search for any of their favorite songs from popular musical artistes of the world. If you want to download mp3 songs to your device and you don’t know where to go to, good you are here. This post guides you on everything you need to know about the Waptrick mp3 download – free waptrick music download, videos, and games portal.

I think this website is great and have found it to be quite useful. Continue the excellent work. Have you heard of the 2023 Facebook Dating App Download Free? There is a large population of singles currently on the use of this feature. And if you are not there yet, then you are missing out on amazing experiences. Dating has taken a new turn and so should you! To help singles scope out their romantic interests, Facebook launched its dating service – Facebook Dating. Do you wish to learn more about this topic? For further information, please visit my blog.

I think this website is great and have found it to be quite useful. Continue the excellent work.

How to Login to 9Now Account – The 9Now login procedure is quick and easy. However, there are still valid reasons for you to log in. You must sign into your 9Now account in order to get free entertainment, news, sports, lifestyles, and radio on all of your devices. You must connect to your account in order to watch live TV and access the fantastic content on 9Now. (Or if you don’t have an account you need to consider getting one).

You can find out more on my blog. Check for further details by visiting. Don’t let this opportunity slip by.

The harrowing experience of losing $200,000 in a Bitcoin investment scam was a painful lesson, but it also led me to discover the unwavering support of ALLEGIANT PRO HACKER. Their expertise, dedication, and relentless pursuit of justice allowed me to recover my lost Bitcoin and regain a sense of security. I am immensely grateful for their assistance and want to emphasize the importance of educating oneself about cryptocurrency scams and remaining vigilant in the face of enticing investment offers. Moving forward, I am committed to sharing my story and raising awareness to help others avoid falling victim to similar scams. With the support of organizations like ALLEGIANT PRO HACKER and increased awareness, we can strive to build a safer environment for all cryptocurrency enthusiasts. Reach out to ALLEGIANT PRO HACKER now through any of the information that is stated below.

Email: allegiantprohacker@proton.me

Telegram: +15625539611

Your blog post is excellent, and I will be back for more interesting and practical posts. Your web page is quite encouraging, so please keep up the excellent work. For further updates that provide further detail on this same subject, which I still want you to study and investigate, please visit my blog.

If you are looking for how to manage your US Bank Mortgage login page and you don’t know. Good you are here. First and foremost, the US Bank Mortgage Login offers you access to make your US Bank mortgage payment, manage your account dashboard, view your loan balance, refinance mortgages, apply for mortgages, view estimated home trends, etc.

If you are looking for a safe way to manage your Pennymac mortgage login portal and you don’t know how to do it, good you are here. First and foremost, the Pennymac Mortgage login gives you access to manage your Pennymac Mortgage account, make your payment, access your loan information online, view statement and documents, apply for a home online, etc.

Are you looking for how to manage your Caliber Home Loans Login page and it seems you don’t know what to do. Firstly, the Caliber Home Loans Login offers you access to sign in to manage your account, make your Caliber Home Loans mortgage payment, view details on your loan, speak to a customer service agent, explore hardship options, and many more.

If you are looking for how to access your Zurich Life Insurance login page and you don’t know what to do, good you are here. Firstly, the Zurich Life Insurance login gives you access to make your Zurich Life Insurance payment, set up your account, view your portfolio dashboard, access your policy documents, change your contact details, and many more.

ARE YOU A VICTIM OF INVESTMENT OR NFT SCAM? DO YOU WANT TO INVESTIGATE A CHEATING SPOUSE? DO YOU DESIRE CREDIT REPAIR (ALL BUREAUS)? SCHEDULE A MEETING WITH AN ETHICAL HACKER ASAP TO GET STARTED.

ASOREHACKCORP is a financial regulator, private investigation and funds recovery body. We specialize in cases as regards ETHICAL HACKING, CRYPTOCURRENCY, FAKE INVESTMENT SCHEMES and RECOVERY SCAM. We are also experts in CREDIT REPAIR, we analyze what’s impacting your score.

All software tools needed to execute RECOVERIES from start to finish are available in stock.

Kindly NOTE that the available tools does NOT apply to CREDIT FIX.

Be ALERT to FALSE reviews and testimonies on the internet, the authors and perpetrators unite to form a syndicate.

Contact our team as soon as you can via the email address below to book a mail meeting with an ethical hacker.

asorehackcorp @ gmail com

Stay Safe out

Do you need an appointment with the best Private investigators in the world???, Who can help you carry out hacking jobs, I was down and depressed when i could not get a job because of my bad credit score, Explaining my situation to a friend of mine i was introduced Premiumhackservices@gmail.com and they did not only help fix my credit score but they also helped me to apply for a loan which i got later and i used it to set my life up, you can also reach them on Whatsapp +14106350697, Do not worry your job will be done confidentially.

REAL AND LEGITIMATE CRYPTO RECOVERY EXPERT

I was actually fooled and scammed over ( $345,000 ) by someone I trusted with my funds through a transaction we did and I feel so disappointed and hurt knowing that someone can steal from you without remorse after trusting them, so I started searching for help legally to recover my stolen funds and came across a lot of Testimonials about ETHICREFINANCE Recovery Expert who helps in recovery lost funds, which I can tell has helped so many people who had contacted them regarding such issues and without a questionable doubt their funds was returned back to their wallet in a very short space of time, it took the expert 21 hours to help me recover my funds and the best part of it all was that the scammers was actually located and arrested by local authorities in his region which was very relieving. Hope this helps as many people who have lost their hard earn money to scammers out of trust, you can reach him through the link below for help to recover your scammed funds and thank me later.

Email Address: ethicsrefinance @gmail. com

Website: www. ethicsrefinance .com

You’ve probably heard about Bitcoin, the revolutionary digital currency that has taken the world by storm. With its decentralized nature and promise of fast and secure transactions, it’s no wonder why Bitcoin has gained popularity among individuals and businesses alike. However, with great power comes great responsibility, and sometimes, things can go wrong. Many find themselves unable to access their Bitcoin holdings, whether it’s because they misplaced their storage device, forgot their password, or fell victim to a phishing scheme. Bitcoin recovery services are useful in this situation. In order to prevent users from losing their hard-earned digital assets permanently, these services are designed to help customers recover lost or unavailable Bitcoins. The Bitcoin recovery landscape is a rapidly evolving industry, filled with both legitimate services and unscrupulous scammers. It’s crucial to choose a reputable and experienced firm to handle your Bitcoin recovery needs. One company that stands out in this space is

Pro Wizard Gilbert Recovery Experts. Known for their expertise and success in helping individuals regain access to their Bitcoins, Pro Wizard Gilbert Recovery Experts has established itself as a reliable and trusted name in the field. With their specialized knowledge and cutting-edge techniques, they’ve assisted countless clients in recovering their digital wealth. In order for Bitcoin to recover, time is of the importance. The likelihood that your assets will go missing or end up in the wrong hands increases with the amount of time you wait. This is the reason it’s critical that you act right away if you can’t access your Bitcoins. Making quick contact with a trustworthy recovery provider, such as Pro Wizard Gilbert Recovery Experts, might improve the chances of a full recovery. In some cases, recovering lost Bitcoins may involve solving complex cryptographic puzzles.

Pro Wizard Gilbert Recovery Experts possess the necessary expertise and computational power to decipher these puzzles and unlock access to your digital wealth. Reach Pro Wizard Gilbert Recovery through: prowizardgilbertrecovery(@)engineer.com, Also Signal username: +1 615-561?5816

Nice one. I really loved this article

This article is fantastic and I got some good information by reading this. thanks a lot for sharing this informative and useful post!

Get $2,000 USD everyday for 2 Years. Contact for more info email: (ethicsrefinance @ g mail com ) TELEGRAM :@ethicsrefinance

GET RICH WITH BLANK ATM CARD, Whats app: + 1 803 392 1735

I want to testify about Dark Web blank atm cards which can withdraw money from any atm machines around the world. I was very poor before and have no job. I saw so many testimony about how Dark Web Online Hackers send them the atm blank card and use it to collect money in any atm machine and become rich I email them also and they sent me the blank atm card. I have use it to get 500,000 dollars. withdraw the maximum of 5,000 USD daily. Dark Web is giving out the card just to help the poor. Hack and take money directly from any atm machine vault with the use of atm programmed card which runs in automatic mode.

You can also contact them for the service below

* Western Union/MoneyGram Transfer

* Bank Transfer

* PayPal / Skrill Transfer

* Crypto Mining

* CashApp Transfer

* Bitcoin Loans

* Recover Stolen/Missing Crypto/Funds/Assets

Email: darkwebonlinehackers @ gmail . com

Telegram or Whats App: + 1 803 392 1735

I was unaware of the many conmen in the crypto world when I invested a huge amount of my savings into a crypto trading platform to make profits from my investments, little did I know that I was being cheated on my investments. The fake crypto platform refused to let me withdraw my money and insisted I pay a chunk of my money for insurance and other ridiculous fees. I thought I had lost everything until I was told about Firmwall Cyber Security Service, a well-known crypto recovery company and data security company, I contacted Firmwall Cyber Security immediately and provided them with the necessary information, and within a few hours, my crypto was released and I got back access to my account. I was truly amazed and I’m here to recommend their services to everyone who needs to recover crypto or has any issues with their crypto wallet.

Their team can contacted via the following: E-mail(Firmwallcyber@techie.com) Web(https://firmwallcyber.wixsite.com/firmwall) What sapp(+ 1 937 542 0667)

When you can no longer access your bitcoin wallet or have your funds stolens or scammed,it is unfortunate.Boris Digital Hacks was able to locate my wallet and provide me access to my bitcoins,I was overjoyed.I was a victim of bitcoin ruse, and I’m extremely pleased that Boris Digital Hacks supported me and had all my funds recovered. I wish to thank them for their excellent service and urge everyone to use them. You can contact Boris Digital Hacks by using:

Email: hackerboris2 @ gmail . com

Whatsapp: +1 30 5 5 1 520 6 3

https://www.tecteem.com/2022-facebook-dating-app-download-free

Your blog was nice and informative.

“Cashlyfaucet” is an awful scam cartel, don’t bother engaging their service for whatever reason. I lost a ridiculous amount of money investing in their crypto scheme. I had to seek help from RestoreChef and with their expertise, they amazingly helped with the full recovery of my funds. Reach their support center via RECOVERYCHEF@TECHIE.COM for assistance.

Opening a savings account is a necessity these days and it brings many benefits.

All the comments given have given me support too.

I Am morgan ,am from united state i Got my already programmed and blanked ATM card to withdraw the maximum of $70,000 daily for a maximum of 20 days. I am so happy about this because i got mine Just week and I have used it to get $200,000. ethicsrefinance is giving out the card just to help the poor and needy though it is illegal but it is something nice . And no one gets caught when using the card. get

yours from him.

CONTACT: (Ethicsrefinance @g mail com)

TELEGRAM: @ethicsrefinanace

You can also contact them for the service below

* Western Union Transfer

* Blank atm card

* Bank Transfer

* PayPal / Skrill Transfer

* Crypto Mining

* CashApp Transfer

* Bitcoin Loans

“Cashlyfaucet” is an awful scam cartel, don’t bother engaging their service for whatever reason. I lost a ridiculous amount of money investing in their crypto scheme. I had to seek help from RestoreChef and with their expertise, they amazingly helped with the full recovery of my funds. Reach their support center via RECOVERYCHEF@TECHIE.COM for assistance.

OPTIMISTIC HACKER GAIUS: IS THE BEST COMPANY FOR CRYPTO CURRENCY RECOVERY AND HOW TO RECOVER LOST CRYPTO FUNDS

The investment scheme initially drew me in with the promise of large profits and the guarantee of a safe investment. But as time passed, I came to see that the investment was a complete fraud. I was left feeling dissatisfied and powerless after losing access to my money. It was a terrible experience, and I thought I was out of choices. I looked up a few cryptocurrency recovery businesses online and read customer endorsements and reviews after doing some investigation. To assist me in getting my investment back, I had to discover a reliable provider. I gave it some thought before deciding to get in touch with OPTIMISTIC HACKER GAIUS who received great feedback and endorsements. Their professionalism and promptness really pleased me, and they offered me hope by thoroughly explaining the recuperation process. After he recovered well, I agreed to review the fantastic work he did. Optimistic Hacker Gaius is a great resource for any fraud victim looking for assistance in recovering their lost cryptocurrency.

Contact details:

email… Optimistichackergaius @ seznam. cz

Call or use WhatsApp at +1..6..0…1..4..6..0..9…4..7..7.

the website page is; https://optimistichackegaius.com

RECOVERY EXPERIENCE WITH DECODE HACKERS

On a Facebook investment page, I got interested in Ethereum cryptocurrency mining and I was sent a link for a company with which I could invest, fun-eth.com. I opened a Coinbase wallet and transferred money to fun-eth.com with Anthony Wilson’s encouragement. Promising that if I invested $600,000 and the company reached the investment goal, I would qualify for the premium big fish seven Ethereum welcome token. Not only did I lose the $600,000, but the scammers were able to steal another $98,000 from the wallet I gave to them. They then told me that I needed to invest another $300,000 by a given date to get access to withdrawals on my account. I contacted a Friend in New Jersey who has been making his way on BTC, he advised me not to make any more payments but instead seek help to recover the earlier investment. He recommended Decode Hackers, who had helped him on earlier Bitcoin recovery. I mailed them via decodehackers@gmail.com (TELEGRAM: +1913843379). It has been over two months since I got my dollars back. Thank you sir and your team for the work well done.

Don’t be deceived by different testimonies online that is most likely wrong. I have made use of several recovery options that got me disappointed at the end of the day but I must confess that the tech genius I eventually found is the best out here. It’s better you devise your time to find the valid professional that can help you recover your stolen or lost crypto such as bitcoins rather than falling victim of other amateur hackers that cannot get the job done. {Lisatheo225 @gmail com is the most reliable and authentic blockchain tech expert you can work with to recover what you lost to scammers. They helped me get back on my feet and I’m very grateful for that. Contact their email today to recover your lost coins ASAP.

A Guide to Recruiting a Hacker to Retrieve Stolen Bitcoin.

My gratitude is insufficient for the outstanding assistance rendered by the renowned OPTIMISTIC HACKER GAIUS. I lost a significant sum of my hard-earned money—$258k worth of Bitcoin—to an online romance fraud, which crushed me. But this group of OPTIMISTIC HACKER GAIUS professionals quickly helped me out and proved their proficiency with crypto recovery. They recovered my lost money in an unexpectedly quick amount of time. Their unwavering efforts and dedication to ensuring client happiness really kept me afloat financially. I would heartily suggest them to anyone facing a comparable situation. Their exceptional assistance and capacity to retrieve significant quantities of cryptocurrency are unparalleled. Details about how to reach us are provided below.

WhatsApp at +1..6..0..1..4..6..0..9..4..7..7.

email… optimistichackergaius @ seznam.cz

website: https://optimistichackegaius.com

OPTIMISTIC HACKER GAIUS: THE BEST CRYPTOCURRENCY RECOVERY /USDT/BTC/LOST WALLET/STOLEN BITCOIN

Do you need help recovering your bitcoin, US dollars, or other cryptocurrency that was lost or stolen? The best, most reliable, and secure Bitcoin recovery company on the internet is OPTIMISTIC HACKER GAIUS.

My lost Bitcoin seemed unrecoverable, but thanks to OPTIMISTIC HACKER GAIUS’s perseverance and his dedicated team, it was eventually made feasible. My intense knowledge and unwavering pursuit of justice paid off, allowing me to fully recover everything that was lost. I will always be grateful for their help, and I wholeheartedly endorse ASSET HACKER’s recovery services to anyone who finds themselves in a similar situation. I promise you they won’t let you down.

WhatsApp at +1..6..0..1..4..6..0..9..4..7..7.

website: https://optimistichackegauis.com

email… optimistichackergaius @ seznam.cz

BEWARE OF THE PITFALLS OF CRYPTO WORLD: I fell victim to a crafty scam, but just when I thought all hope was lost, IRON CLAD CYBER RECOVERIES emerged as a beacon of light. For a fact, bitcoin is true and is the future of world currencies. I have been using it until I lost 7 BTC in the hands of unregulated brokers. In the wake of losing my monies to this sham investment brokers, I found myself in a state of panic and despair. Fortunately for me, an old friend who previously worked with my uncle referred me to IRON CLAD CYBER RECOVERIES. I participated in an in-depth consultation to understand the details of the theft and the extent of the loss I suffered. They created a customized recovery plan that met my specific need using their extensive knowledge of blockchain technology and forensic investigative skills. With their sophisticated and robust technological firewalls, my case was investigated and IRON CLAD CYBER RECOVERIES were able to recover my stolen cryptos in less than 72 hours. Working with IRON CLAD CYBER RECOVERIES was a transformative experience, not only did they recover my stolen funds, they also demonstrated a level of professionalism that exceeded my expectations. I appreciate them for their help and I wish to recommend them to everyone caught up in systemic scams. Please contact IRON CLAD CYBER RECOVERIES for your swift recovery. Email Address: Ironcladcyber@techie.com, Telegram: @ICCRECOVERIES, W/App: +1(623) 688-8815

Good day, my name is Mary, and I’m Asian American….

While looking for help after losing $165k in Cryptocurrency to an unregulated trading platform , I came across numerous endorsements and testimonials about this Team Recovery. I sent them a direct message, to which the replied and requested some information, which I also provided. After five hours of working with me. and because it took me two weeks to find ASSET HACKER RECOVERING Team, they where able to recover back my funds, i was overjoyed because I didn’t think it was possible. Thanks to team ASSET HACKER…. If your cryptocurrencies have been stolen in any way, contact Team ASSET HACKER as soon as possible. Reach them via; Email: Assetcryptohacker@proton.me, Whatsapp:+393510777769, Telegram@Assetcryptohacker.

In the spring of last year, i started my journey to financial independence by investing in the most trending digital assets widely known as Bitcoin. Bitcoin as we all know it’s highly valuable with its potentials still looking very promising with each and every new day that it extends its reach to the world. I made an attempt to buy into the future which was actually going quite well until I decided to exploit it’s full benefits for more gains. I was poached on Telegram to join a seemingly legitimate trading platform… BIG MISTAKE …BIG MISTAKE but thankfully JETHACKS RECOVERY CENTRE came just in time to save the situation. The firm was highly recommended by a close friend of my family, who happens to be in the intelligence professional network. At first, I didn’t quite see the possibility of this working out but what more do I possibly have to lose?.. I hoped it’d work out so I gave them a shot and after our first initial consultation I was 110% sold on his firm’s services. I signed up immediately. you get what you pay for just like he assured me from the onset that I would have my funds recouped back to me from the scammers within 2days… the team was very diligent and kept me informed every step of the way on Email : JETHACKS 7 @ GMAIL . COM where we maintained communication. I must say one of the most professional things about working together is that he can relate to you on a personal level. How many people in the Recovery field are honest and genuinely ready to help you out ( however difficult your case may be )?!?.. JETHACKS RECOVERY CENTRE is wonderful, they helped me recover from financial ruin. I am grateful to them for making me financially stable again in a very short period of time, I’m on course to buy my first house at age 43. I feel so blessed to have found this company and got to have my funds recovered back to me, I would definitely suggest working with this AMAZING FIRM!.. here is their official TELEGRAM username @ JETHACKSS for additional support.

Hire A Reputable Crypto Recovery Agent “ASSET HACKER”

My name is Ciara,I’m a content manager residing in Germany. Last month, I was duped online when I was introduced to a cryptocurrency trading website by ”international broker” on the internet, as he claimed to be. He persuaded me till I agreed to invest $252,000 with him. When my account reached a profit of $452,000, it was frozen, and I was asked to pay a large tax to enable my withdrawals. I decided to look for a bitcoin expert on Google. During my study, I came across Asset Hacker, a reputable hacker with special cyber skills required to recover lost funds. I contacted them and appealed to him for assistance to help me recover my funds. His service was excellent. I wholeheartedly suggest them to anyone who has been duped out of their funds.

Email: Assetcryptohacker@proton.me

Whatsapp: +393510777769

Telegram@Assetcryptohacker

HOW TO FIND LEGITIMATE CRYPTO RECOVERY COMPANIES / OPTIMISTIC HACKER GAIUS

Have you ever encountered cryptocurrency theft? Have scammers or hackers stolen your hard-earned Bitcoin? Don’t worry!

OPTIMISTIC HACKER GAIUS is a professional cryptocurrency recovery agent who can assist you in recovering your stolen bitcoin and reclaiming what is rightfully yours. Make touch with him immediately and thank me later.

Email address…. (optimistichackergaius @ seznam.cz)

WhatsApp: +1 6,0,1 4,6,0 ,9,4,7,7

Website: https://optimistichackegaius.com

If you’re not familiar with cryptocurrency trading, I strongly advise you to either stay away from it completely or invest very cautiously. I was forced to invest a significant amount of my life savings on a forex platform to increase my profits, but I ultimately lost roughly 95,000 USD to this investment scam. I was not allowed to take my money out after I had invested and made a profit. I sent a letter to customer service, but it was ineffective, so I realized I had been duped. I was fortunate enough to come across a genuine deal retrieval WEB WIZARD after much looking for ways to acquire assistance. I decided to give it a shot and explained my condition to them. they gave me their word that they would help me get my money back. Honestly, they performed a fantastic job, and my money was recovered in my wallet in less than 24 hours without any upfront payment. I appreciate having encountered WEB WIZARD with such exceptional abilities, it’s truly remarkable.

TELEGRAM: +1 (954) 4514332

Whatsup: +1(580) 2801390

EMAIL: bestwebwizardrecovery@consultant.com

I sincerely believe that a deep sensitization program will massively help to curtail the damages and activities of internet fraudsters of which it seems the most popular ones are the crypto and forex trading platforms/companies. Prevention they say is better than cure, not everyone might be lucky enough to come across legit and ethical recovery solution like some of us did thus a proper awareness program, podcast, seminars could’ve gone a long way to help people avoid getting scammed trying to get into any of the very lucrative above mentioned investments. I also do understand that it is only right for one to audit properly a prospective financial company before getting involved but since there’s not much pre existing knowledge of the pros and cons of this things and most prospective investors are newbies, we easily get blindsided by their exciting offers. Thanks to JETHACKS RECOVERY CENTRE, Just few days ago I was finally able to get a sound night sleep after a very challenging past few months. So I got invested with a trading agent that supposedly facilitates trading for her clients but in reality everything was just on paper and it was revealed to me her malicious practices and trades manipulation in order to line up her pockets with funds belonging to others. I felt trapped because I have paid some huge fees to clear up my withdrawal before I got to realize their game plan. Honestly, it’s a miracle I lived through that period.. this things were very new to me so I didn’t know who to ask for help, even the authorities did so very little to help me apprehend the culprits. Luckily a friend of mine recommend I appeal my case with JETHACKS RECOVERY CENTRE and hopefully, they will be able to use their team to trace the culprits and retrieve back my stolen funds. Well guess what ?.. this is the best decision i ever made in my life trust me! .. within a few days after I reached out to this team, they got to recover back my funds from the scammers account and also shut down their website. You can contact the team for help on Email : JETHACKS 7 @ GMAIL . COM or on Telegram, username @ JETHACKSS. come back here tomorrow to share your testimony and help spread the word, let’s join hands together to fight this global pandemic

I just had to put this out here because the truth is,everything that people tells you about digital assets recovery is not entirely true. I understand our past experiences is a huge deciding factor in our decision making and this alone, can easily change one’s perspective regarding the possibility of retrieving your rightful possessions especially when you’ve run into false agencies or firms impersonating the real guys. Initially, many people had told me that the chances of repossessing digital assets were very slim therefore I could either walk away from everything or try to pay off the required withdrawal fee in hopes that they will keep to their words but the problem was, it never stopped coming. I’m 54 years old and I knew within myself that am just being stringed along even though I didn’t want to admit it to anyone else because why do I have to pay an obviously manufactured tax levy of 56,000 usd before I could withdraw the balance on my portfolio, that’s a ridiculous amount of money that I could not afford given my financial situation at the time. With each payment giving rise to another issue, it became crystal clear to me what I had gotten myself into. I have known about JETHACKS RECOVERY CENTRE on Telegram user @ ‘’JETHACKSS ‘’ from my working days at Amazon so I decided to enquire about their services regarding my particular situation and thankfully they responded and gave assurances of being able to help even though I was quite anxious about this getting accomplished, but it was worth giving a shot so we went for it. A few days after we started the program, I started to see progress because he always kept me in the loop, the fraud company website already shut down like a month ago so I was scared that it could affect my case but the effort of the team proved to be efficient enough, with their skills and vast experience in this field, I got to have the full amount that was stuck on my portfolio balance recovered back to me on the third day, like a ray of sunshine my life shun bright again thanks to the JETHACKS RECOVERY CENTRE and team. You can also contact the team using their email support; JETHACKS 7 @ GMAIL . COM or via the Telegram username above.

Owning a home-raised intelligent parrot from https://homeraisedparrots.com brings joy, companionship, and mental stimulation into your life. Our parrots, including macaws and African greys, are bred in a loving home environment, ensuring they are well-socialized and healthy. Unlike mass-bred birds, they receive individualized care, making them more adaptable and affectionate. Adopting from us (homeraisedparrots.com) guarantees a high-quality, intelligent parrot ready to become a cherished family member.

https://access2ship.com is your premier destination for global freight and flight shipping solutions. We specialize in seamless logistics, working with major seaports and airlines worldwide to ensure your cargo reaches its destination efficiently and safely. access2ship.com extensive network spans key locations, including the USA, UK, and beyond, providing unparalleled access to international shipping routes. With a commitment to reliability and customer satisfaction, Access2Ship.com handles all your shipping needs with precision and care. Trust us to deliver your goods, Pets and parcels across the globe with the highest standards of service and expertise.

Choosing an exotic pet from adoptexoticpets.com rewarding experience that brings a touch of the extraordinary into your life. Whether you’re captivated by the elegance of the Savannah Cat, the cuteness of the Pygmy Hedgehog, or the intelligence of the Capuchin Monkey, each of these animals offers something truly special. At https;//adoptexoticpets.com, we’re here to help you find the perfect exotic companion and provide you with the information and support you need for a happy and healthy pet ownership journey.

I was scammed by a Bitcoin investment online website in august. I lost about $350,000 to them and they denied all my withdrawal request, and gave me all sort of filty request. It was a really hard time for me because that was all I had and they tricked me into investing the money with a guarantee that I will make profit from the investment. They took all my money and I did not hear from them anymore. I was able to recover all the money I lost just last month with the help of hack4wise @gmail com. I paid 10% of the recovered funds as his service charge after I got all my money back. I am really grateful to him because I know a lot of people here have been scammed and need help. Contact him via;hack4wise @gmail com

This is how i was able to get back my stolen funds in crypto

I lost about $30,000 to 2 fake binary options as well. Still, I am sharing my experience here so as to enlighten and educate everyone who is losing money or has lost money to a scam including binary options, dating scams, fake crypto investing schemes or platforms, real-estate scams, Mortgages, and fake ICOs. However, I have been able to recover the money I lost to the scammers with the help of a recovery professional and I am pleased to inform you that there is hope for everyone who has lost money to scam.

Name: Sylvester

Yt7cracker@gmail. com Also available on Instagram; Yt7crackersz

At first, we chose JETHACKS RECOVERY CENTRE because he was referred to us by a reliable source who’ve engaged his services with a lot of success in the past. With so many recovery testimonies out there, it was difficult figuring out the right recovery firm that we could trust but I am so glad that we went with this firm. The recovery program which lasted for a couple of days was super handled after which my husband and I went from being debtors to having all our debts repaid and renting to buying our own home. My husband and I debt was far too high to go through with purchasing a long overdue new home, we lost a huge portion of the funds to a stock broker investment company which he connected with on Linkedln. At first it was going great which also made me join the company and with that much motivation, we both funded huge balances on our accounts respectively. We had no idea they were a fraudulent company until it was already too late. we were very devastated thinking we’ve lost almost all our life savings to scammers, the loss was too much to bear so we resolved to finding a solution. Where we first contacted the firm was on Telegram, the agent assigned to handle our case thoroughly reviewed all the details and gave us our options before the team starts the process. Unlike most other recovery firms, we weren’t asked to pay any fee whatsoever before having our case reviewed and assured us of the successful recovery of our funds. This team possesses a sweeping knowledge and overall great experience in the recovery field and knew exactly how to get the job done. There’s a saying that ‘’ you don’t pay the plumber for banging on pipes, you pay him for knowing where to bang’’, I have indeed witnessed this first hand during my time working with the team. Once the extraction process was complete, we got a deposit alert on my husband’s Blockchain wallet and we quickly liquidated everything into our bank account. Today I write this from the comfort of our newly purchased home, Special thanks to the best recovery firm in the world, I will forever be grateful and won’t hesitate to refer this company to any friend who tells me they’re facing similar situation to get help from the JETHACKS RECOVERY CENTRE on any of their contacts informations, Telegram username @ JETHACKSS OR Email : JETHACKS 7 @ GMAIL . COM

ARE YOU A VICTIM OF INVESTMENT OR NFT SCAM? DO YOU WANT TO INVESTIGATE A CHEATING SPOUSE? DO YOU DESIRE CREDIT REPAIR (ALL BUREAUS)? SCHEDULE A MEETING WITH AN ETHICAL HACKER ASAP TO GET STARTED.

Let us show you the art of Ethical Hacking….!

EMERALD HACKS is a financial regulator, PRIVATE investigation and funds recovery body. We specialize in cases as regards ETHICAL HACKING, CRYPTOCURRENCY, FAKE INVESTMENT SCHEMES and RECOVERY SCAM. We are also experts in CREDIT REPAIR, we analyze what’s impacting your score.

All software tools needed to execute RECOVERIES from start to finish are available in stock.

Kindly NOTE that the available tools does NOT apply to CREDIT FIX.

Be ALERT to FALSE reviews and testimonies on the internet, the authors and perpetrators unite to form a syndicate.

Contact our team as soon as you can via the email address below to book a mail meeting with an ethical hacker.

emeraldhacks(.)org @ gmail(.) com

Stay Safe out there !lili

ARE YOU A VICTIM OF INVESTMENT OR NFT SCAM? DO YOU WANT TO INVESTIGATE A CHEATING SPOUSE? DO YOU DESIRE CREDIT REPAIR (ALL BUREAUS)? SCHEDULE A MEETING WITH AN ETHICAL HACKER ASAP TO GET STARTED.

Let us show you the art of Ethical Hacking….!

EMERALD HACKS is a financial regulator, PRIVATE investigation and funds recovery body. We specialize in cases as regards ETHICAL HACKING, CRYPTOCURRENCY, FAKE INVESTMENT SCHEMES and RECOVERY SCAM. We are also experts in CREDIT REPAIR, we analyze what’s impacting your score.

All software tools needed to execute RECOVERIES from start to finish are available in stock.

Kindly NOTE that the available tools does NOT apply to CREDIT FIX.

Be ALERT to FALSE reviews and testimonies on the internet, the authors and perpetrators unite to form a syndicate.

Contact our team as soon as you can via the email address below to book a mail meeting with an ethical hacker.

emeraldhacks(.)org @ gmail(.) com

Stay Safe out there !iiiiil

I am aware that recovering stolen Bitcoin is not always achievable, but you, daniel meuli web recovery, made it possible for me. I sincerely appreciate your knowledge, rigor, and commitment. I also want to express my gratitude to your team for their efforts and support. They were always available to respond to my inquiries and give me case updates. With daniel meuli web recovery, I felt safe and secure. I sincerely appreciate your assistance in getting my Bitcoin back. My faith in the crypto community has been restored by you. I shall always be grateful to you: hackrontech@ gmail.com

How do you feel when been cheated on? It hurts so much loving someone and you feel your spouse is cheating on you but you don’t know how to figure out. I will introduce you to a verified professional hacker who specializes in hacking like phones, computers, WhatsApp, Facebook, retrieve lost cryptocurrency, recover wallet, delete criminal record, track GPS location. If in need of upgrading grades, credit score and more. He also offers such service. I saw his lots of recommendation on reddit and i also tried him out. I love his quick responds and quality service. He helped me access my partner phone and i found out his cheating, right now my partner is apologizing to me cos he was shocked i knew about it, i have access to his call logs, deleted messages, text messages and more. All thanks to ( spyhackelite @gmail com ) for his good works.

I know and can recommend a very efficient and trustworthy hacker. I got his email address on Quora , he is a very nice and he has helped me a couple of times even helped me recover stolen funds in my Coinbase account at a very affordable price. he offers a top notch service and I am really glad I contacted him. He’s the right person you need to talk to if you want to retrieve your stolen crypto currencies & bitcoin accounts, deleted/old texts, call logs ,emails ,photos and also hack any of your spouse’s social network account Facebook, twitter, Instagram, messenger chats, snapchat, reddit, telegram, tinder and WhatsApp, He offers a legit and wide range of hacking services. His charges are affordable and reliable, This is my way of showing appreciation for a job well done. contact him for help via address below.. Email : hack4techspy @gmail com.

Write to hack4techspy at google mail c 0m, They were actually my life saver. It is hard to tell how difficult it’s to find a genuine and reliable hacker. This guy “hack4techspy” puts a stop to my problems & fears

Finally, there is a reliable and effective service we all can rely on! I can only imagine how many people are having problems with crypto-related issues and are likely also unsure of their ability to find practical solutions. Easyreclaim is rightfully the best provider of recovery service and their ability to recover funds very fast. They helped me to recover 850,000USD that I lost due to online cryptocurrency theft Get in touch with them on:easyreclaimer@gmailcom They are simply the best recovery company.

Life throws you on a roller coaster, and for some like myself, loosing your life savings is the worst thing that can happen to you because you are just trying to handle the downs of life so you can get back up. Once things in my life were better, that is when my life took a turn for the worse as by every indications, i seemed to have lost my funds to a fraudulent crypto and stock trading company. There’s no way I would be able to survive the cruel reality I was facing. I read reviews for the leading digital assets recovery solutions out there including JETHACKS RECOVERY CENTRE. some had good and not so good reviews. After about a month of research on the companies, I decided to go with JETHACKS RECOVERY CENTRE because I had a great conversation with one of their agents on their Email support : JETHACKS7 @ GMAIL . COM where I initially made my enquiries. I got set up and this is how it has been so far:

I started working with JTHs on a Tuesday and I got my funds recovered by the eve of Friday. To this date, the scammers have no idea the funds went to my wallet after I told them off when they contacted me trying to figure out what had happened to my funds. In my experience so far, I have come to find out you need to have believe for the process, but the team’s process does all the work. Yes, you have to be strong willed to go through with this, but if you are serious about recouping your assets, then this is absolutely such a small task. They have great customer service and they don’t give you fluff, they are honest about what you should expect. customer support and transparency level is very impressive, they keep you updated of the progress every step of the way. All of this allows me to monitor the progress without having to pick up the phone to ask someone from the team but If you do have a question and need to speak with someone, they are very responsive. This experience has been a very good one for me, I wouldn’t have been able to do this on my own, Thank you for what you have done and will continue to do for me, JETHACKS!.. they have a telegram support also, the username is @ JETHACKSS

Are you suspecting your partner of cheating or having an extramarital affair? I’ll advice you to get proof first before confronting him/her. As that could result in unnecessary confusion in your relationship or marriage. it’s always advisable to consult a professional hacker to help you get concrete evidence by discreetly getting access to their phone or computer. he has forked for me a couple of times and he never disappoints. he provides Accurate results and can be trusted for 100% privacy and untraceable.

Contact him via spyrecovery36 @gmail com

I’m a born skeptic, and did not trust that anyone could actually trace and recuperate funds lost to scammers and their Ponzi schemes. I begged and pleaded with Capitalix group to honor the terms of our initial agreement and release my funds to me, But they refused. They like to say that you have settle a fee every time I attempt to withdraw my funds, but I think they do that because they don’t want to payout the funds but they use different lies to keep extorting more funds from me exploiting on my desperation and possibly wear me out in the long run. Once I got JETHACKS RECOVERY CENTRE involved, things happened fast. It was night and day from what the Capitalix group put me through when I tried to deal with them myself. Get the pros involved, it’s worth the risk. These guys are the best. Our lacking in this area of specialty makes it impossible for you to then fight fraudulent investment cases like this because even if you’re right, but you refuse to pay something, they hang your assets and ruin your financial future. And no one cares “why” it’s ruined, they just want to hear your story and then look to lay blame’s on you for trying to improve your life. So, what do you do? You keep paying the scammers even if you disagree with the charges so that they could release your funds but that’s the irony there because you will never get paid only getting yourself more destroyed. I had been dealing with this issue for almost a year until I eventually admitted the truth to myself that i had been scammed, and then report my case to the JETHACKS RECOVERY CENTRE So they can intervene and help me repossess my assets before it was too late. The recovery process was launched and swiftly concluded within 72 hours, my funds went from pending to available inside my Coinbase wallet. Total turnaround. What took me a year of work and still had no resolution JETHACKS fixed in 72 hours. I’ve been kicking myself for not contacting someone for help earlier, but I just didn’t believe it could be done. But they did , reach out to them today on any of their available support channels to get help,

EMAIL ADDRESS: JETHACKS 7 @ GMAIL . COM

TELEGRAM @ JETHACKSS

The truly scary thing about undiscovered lies is that they have a greater capacity to diminish us than exposed ones. When people cheat in any arena, they diminish themselves-they threaten their own self-esteem and their relationships with others by undermining the trust they have in their ability to succeed and in their ability to be true. Cheating is the most disrespectful thing one human being can do to another. If you aren’t happy in a relationship, end it before starting another one. respect a person who is loyal in a relationship, by cheating on him or her. If you succeed in cheating on someone, don’t think that the person is a fool, realize that the person trusted you much more than you deserve. If you notice any suspicious act on your partner if he or she is cheating. You need to write MR FRED to help you remotely spoof on the target phone to retrieve text messages, call logs, social media activities, bank information and many more. They deliver the best services and get you the peace of mind you deserve. Email: hack4techspy @gmail com

In December of 2023 my financial situation was a disaster after loosing my entire life savings to a brokerage corporation. As a newbie I was connected to a brokerage company which acted as an intermediary between me and the financial markets. Usually they secure my digital assets and use it to invest accordingly in various financial services such as crypto, stock, ETFs. I believed this company to be legit, this led me to unequivocally trust them with my financial future. My initial plans was to secure my assets with their company till after retirement but when an emergency came up, I had to fall back to my savings but on placing a withdrawal request, I was told I needed to pay a refundable deposit to process my withdrawal which I paid and waited 5 days as required yet no payment came through. I called again and was told this would be escalated to the financial department and a new payment was required then 5 day clock started again. After another 5 days I called to find out what was going on and was asked to make another payment as a result of some bs story they made up, I refused and as a consequence of that my account was frozen and all assets placed on hold. A realtor recommended JETHACKS RECOVERY CENTRE to me. And normally I would have brushed her off, but she was very enthusiastic about how they helped her colleague at work. my 6th appeal had just been turned down by them so I had nothing to lose in signing up the help of Top professional Recovery Team, that was on the 31 of may. Now 3 days after, the team successfully recovered my USDT assets from the broker company. Not just recovered in wallet, but I have liquidated everything to my bank account. From not being able to afford a proper meal to having everything, that’s the happy ending i labored for. I’ve recommended the realtor to everyone I meet, she has become part of our family. And of course i strongly recommend signing up with JETHACKS RECOVERY CENTRE to get your assets recovered,

Email: JETHACKS 7 @ GMAIL . COM

Telegram : JETHACKSS

Most of these cheap spyware’s do not really offer value for money. The IT firm I work with hires two ethical hackers from time to time. They might be able to help, They mentioned they offer phone spying services. They are very discreet so I cant share their contact details here. They always say putting themselves out there will blow their cover so they try to remain anonymous. You can write me using this email address if you want more details,hack4techspy @gmail com

Most of these cheap spyware’s do not really offer value for money. The IT firm I work with hires two ethical hackers from time to time. They might be able to help, They mentioned they offer phone spying services. They are very discreet so I cant share their contact details here. They always say putting themselves out there will blow their cover so they try to remain anonymous. You can write me using this email address if you want more details,hack4techspy @gmail com

Most of these cheap spyware’s do not really offer value for money. The IT firm I work with hires two ethical hackers from time to time. They might be able to help, They mentioned they offer phone spying services. They are very discreet so I cant share their contact details here. They always say putting themselves out there will blow their cover so they try to remain anonymous. You can write me using this email address if you want more details,hack4techspy @gmail com

I have been with a cheating spouse before and trust me I know how it feels, those suspicions are not mere paranoia. If you suspect that he is cheating, he definitely is..I hired a PI who helped me install monitoring bugs on his phone that diverted all his messages( facebook, whatsapp, text messages, and even phone calls) to my phone hack4techspy @gmail com is the man for the job with a very high level of professionalism, honest and highly reliable. I really enjoyed working with him and the few friends I told have been nothing but thankful to me for the referral.

Contact him Via; hack4techspy @gmail com.

I Appreciate iBolt Cyber Hacker for Recovering My Bitcoin from fake Investment

I recently fell victim to a fraudulent investment scheme that resulted in the loss of $75,300 worth of Bitcoin. I really Felt helpless and lost, I wrote iBolt Cyber Hacker on their website for assistance. Their reviews for recovering stolen and lost cryptocurrency gave me hope to contact them.

I am profoundly grateful to iBolt Cyber Hacker for their recovery service. They transformed a nightmare into a success story, Their ability to recover cryptocurrency fraud is truly remarkable. i told them i will give my review, they really deserve it

If you are really facing this challenges, I truly recommend iBolt Cyber Hacker.

Their Real Contact

Email: Support@ ibolt cybe rhack . com

Cont/Whtp .+39. .350. .929. .0318.

Website: https : // ibolt cyber hack . c om/

The results are good. If getting your funds swiftly recovered is your goal, this is your company. Their system is “no frills”. Here’s the kicker, once they accept your case, then it is 100 percent guaranteed to be recovered successfully, their team is the best. This is the difference between JETHACKS RECOVERY CENTRE and the rest other recovery firms. Previously I had used one recovery company and also a recovery agent before now, both ended up finessing me out of the little money I had left. This team offers you transparency and accountability for each step deployed during the process of recovery and their process is designed to accurately attack your specific situation. As far as actual recovery goes, JETHACKS RECOVERY CENTRE system is always more effective, quote me anywhere!. They took the time with me going over my case and how best to proceed to ensure the funds is surely repossessed from the scammers account. I entered an agreement with a certain investment platform in good faith but in the end, they tried to play some underhanded tricks to avoid holding up to their end of the agreement. After about 4 months of engaging their services, their payment gateway suddenly stopped working automatically and when I tried to work it out with the Admin, They pressed me for more payment because the Admin would not authorize me in withdrawing my payments, but instead I had to clear some series of fees to the point where I couldn’t afford the next one. So I was forced to explore alternative means to possibly recover my assets and that was how I luckily found great reviews speaking highly of this team and how they’ve been very helpful in resolving cases like mine.. I hoped they’d help in my situation as well so I consulted their services using their contact details i got online, Email : JETHACKS 7 @ GMAIL . COM and Telegram ID @ JETHACKSS , thankfully they responded back, accepted my case and restored happiness to my miserable life within 48 hours. I can only say Tremendous things about this team, you can contact them as well to assist you.

Reviews and comments can be helpful most times. permit me to share that, in the first week of March 2024, I was convinced to invest in a fake Altcoin cryptocurrency platform through someone I connected with on Telegram , which I did but unfortunately after investing my money I discovered I could not withdraw or access my account on the fake platform. Lucky for me, I came across a review on funds recovery and I contacted Coin Reclaim Service, and through their help and support I was able to recover my money. Losing money trading crypto can be frustrating but I am happy today that my funds are recovered and I wish to share with you their contacts as i know i am not alone on this boat, nobody deserves to be in such situation.

Telgram: COINRECLAIMSERVICE

COINRECLAIMSERVICE [AT] GMAIL . COM

Wassap : +1 (360) 831-8690

I had a lot of optimism going into business with this company and future plans for myself when I started earning. Initially i wanted to subscribe the top tier plan hoping to accumulate as much earnings as possible but the rep initially discouraging me from just enthusiastically jumping to the top, told me that this was a company of integrity and they propose to build with me, as well as my trading history. I’m not trying to pull the wool over anyone’s eyes, and I liked that the rep’s position was, start small and grow big with time. That’s how I got ensnared into their net. So I started with a much lesser package and when I saw everything went according to what they promised, only then did I proceed to elect the highest tier investment program with an expected growth of 5% fixed ROI throughout my time with the company. That being said, you are at the mercy of these people to properly utilize your funds and remit back both profits and initial capital to you as agreed upon. According to their trade regulations, Every withdrawal request has to go through a 3 day processing time. All you’re required to do is place the request, this is something anyone can do even from their sleep yet I encountered some unexplainable complications while attempting to withdraw my balance. They also told me that I had to remit some payment on different occasions to have the request approved. A friend recommended I recruit the services of JETHACKS RECOVERY CENTRE which have proven to be highly effective in resolving situations like mine. Thankfully their efforts worked out as they had my assets traced and recouped from the fraudulent company, I have no idea how they pull something difficult as this but am thankful they did, it saved my life from destruction. I think everyone’s situation is different, but they have experience dealing with all kinds, so you can as well reach out to them for help should you be experiencing something similar to this situation, they’re available on Email : JETHACKS @ GM AIL . COM and on Telegram via the username @ JETHACKSS

Superb layout and design, but most of all, concise and helpful information. Great job, site admin. Take a look at my website Webemail24 for some cool facts about Mobile Operating Systems.